- Tech Rundown

- Posts

- 📉🤖 Accenture Lost $60B Because of AI

📉🤖 Accenture Lost $60B Because of AI

Scraping competitor email sequences to monitoring patent filings: Inside the intelligence operations that traditional consulting never saw coming

The consulting industry is having what you might call a moment. Accenture lost $60bn in market value this year after new bookings declined for two straight quarters. McKinsey cut 10% of staff in one of their largest layoffs ever. PwC followed with 1,500 US cuts. Even the gen-AI contract pace at Accenture (supposedly the future of consulting) slowed from $200m quarterly to $100m.

The problem isn't that AI can replicate the work of a $500k consultant with a single prompt (you definitely can't... yet). But deep research from OpenAI and Google has gotten remarkably helpful at getting you up to speed on new topics and interpreting high-level data. Why pay someone $500-1,000 an hour to synthesize information when you can get most of the way there yourself?

Traditional consulting firms built their value proposition on having smart people Google things really well and synthesize public information into PowerPoint decks. That particular skill is becoming less valuable by the quarter.

So if you run a consulting firm, what can you feasibly do?

The likely options seem to be: turn services into scalable tools like SaaS, or acquire proprietary data to build defensible, differentiated industry solutions: data that AI can't generate because AI doesn't have access to it.

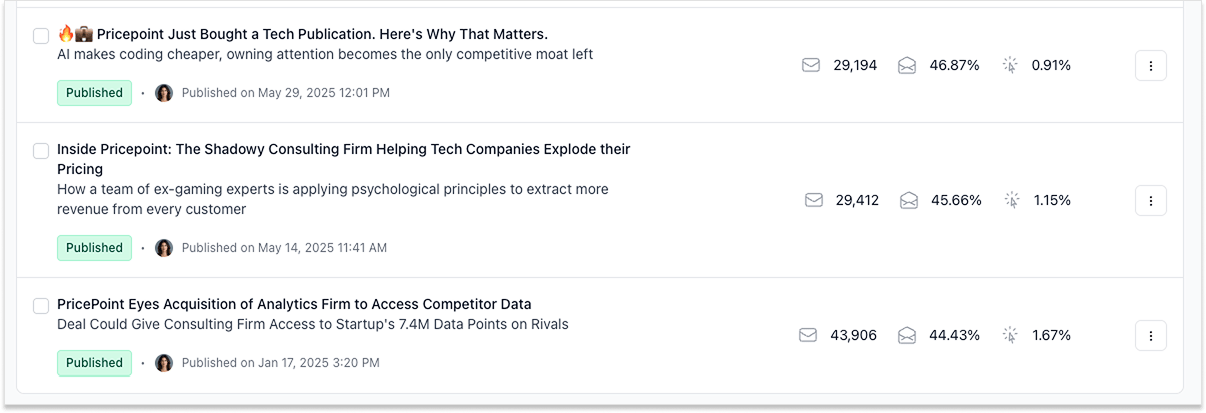

I've covered Pricepoint a couple of times before and have gotten increasingly interested in their approach after seeing them make acquisition after acquisition to access proprietary data and build out more solutions than any normal consulting firm would attempt. For this piece, I spoke with more than 10 users of Pricepoint from half a dozen of their clients and got access to their sales deck and screenshots from multiple client dashboards.

What I found was a consulting firm that's trying to redesign what the consulting model looks like entirely.

The Shift from Labor to Data

Instead of relying on episodic, project-based work, Pricepoint seems to have shifted their offering around proprietary data on growth engines, conversion rates, and pricing changes they scrape on clients' competitors, to provide competitive intelligence and data-backed insights that other consulting firms simply can't offer.

This shift matters because it fundamentally changes what clients are buying. Traditional consulting sold process, smart people who could synthesize information and think through problems. Pricepoint is selling information asymmetry… access to data competitors can't get.

This is significant because it changes the economics (data scales, labor doesn't), it changes client dependency (from episodic to ongoing data access), and it changes competitive dynamics (from "best thinking" to "best data").

The unit economics don't justify building vertical-specific data infrastructure when you also serve pharma and energy companies. But when you only work with B2B SaaS firms between $2-50M ARR, suddenly building these systems makes sense.

Rather than sending junior consultants to Google competitors and synthesize public information, Pricepoint has built software tools that automatically scrape and analyze competitive intelligence. Their consultants still provide strategic recommendations, but they're now operating from a foundation of proprietary B2B SaaS data that clients can't replicate internally.

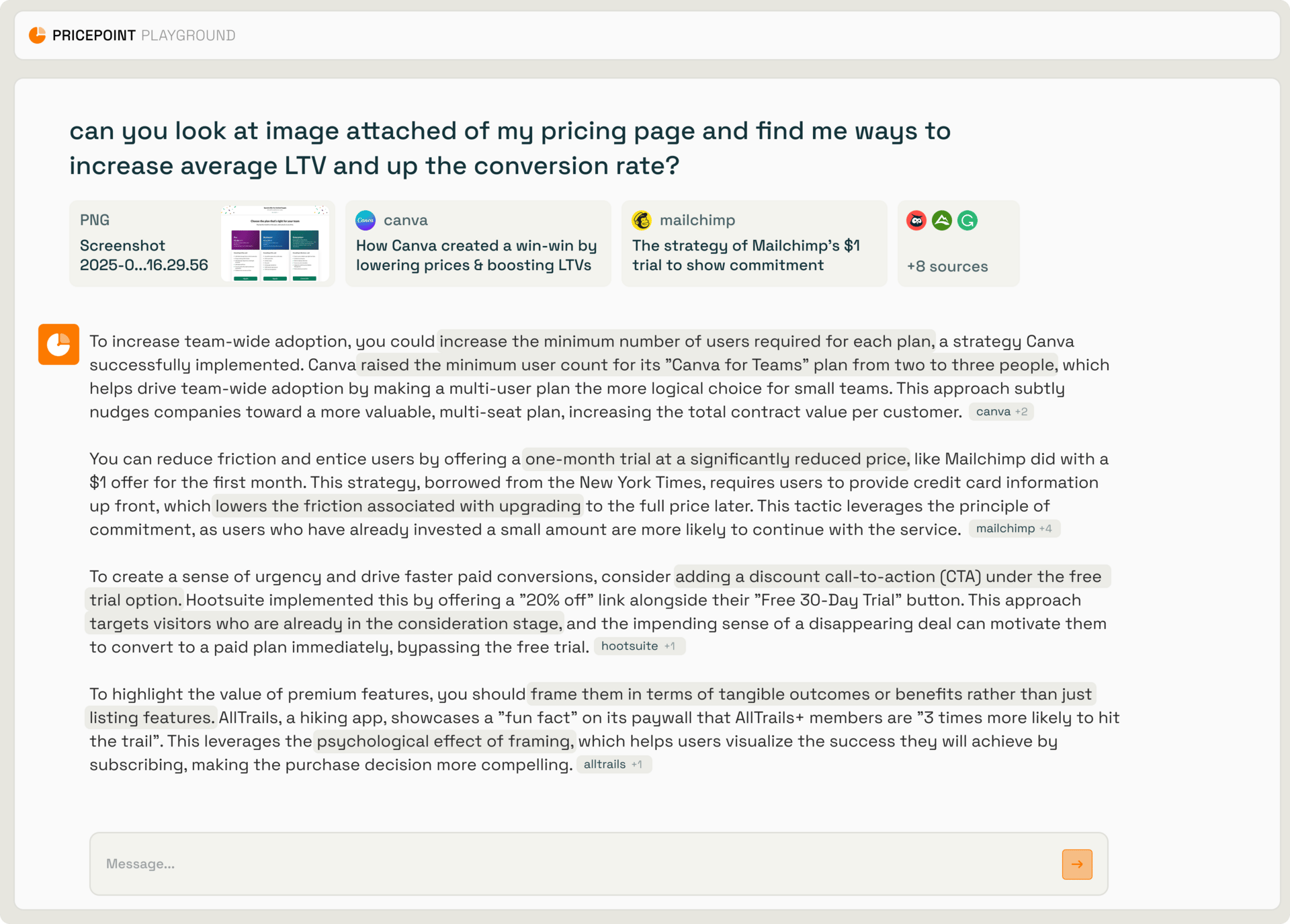

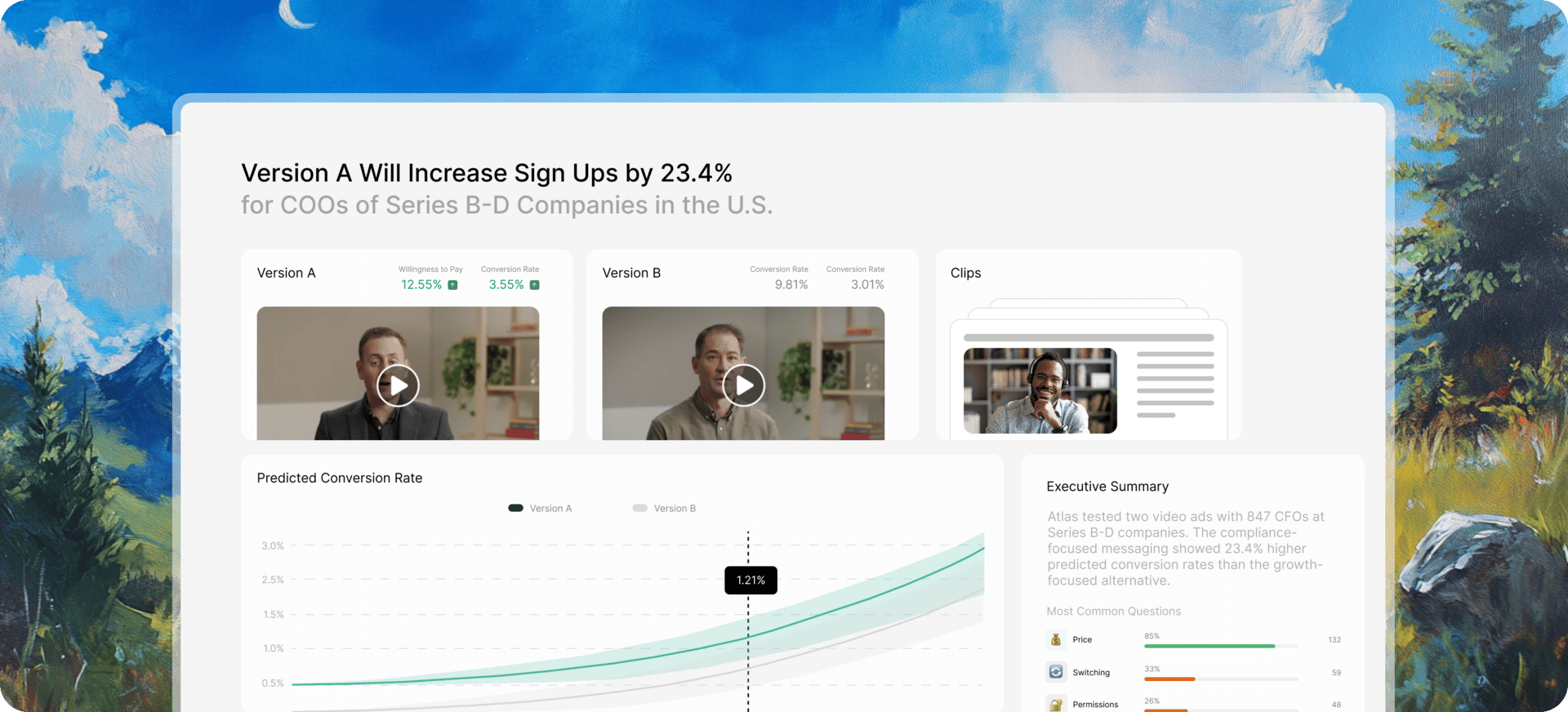

The first thing new clients seem to get access to is a custom-trained AI they can speak with. Upload screenshots of your product and get unlimited access to insights drawn from thousands of A/B tests, without getting charged $500 per hour for consultant time. Clients can ask what moves they should make and get 70% of the value with data-backed case studies of what changes other companies made.

This allows Pricepoint’s team to deliver immediate value while traditional consultants are spending the first 1-2 months just doing analysis and due diligence. It also likely forms the foundations for their initial suggestions, allowing them to generate recommendations faster and base suggestions on past successes rather than the starting from scratch with every project.

Pricepoint’s AI Chatbot

The result is something that looks less like traditional consulting and more like competitive intelligence software with consultants attached.

Here's what I can gather they've actually built from speaking with clients:

CFO Simulator: They scraped hundreds of software buyers at SaaS companies. For each CFO, they collected every LinkedIn post, comment, and article from the past two years. Conference presentations and podcast appearances where they discussed priorities and challenges. Recent job postings from their companies (what you're hiring for reveals what you're struggling with). Previous companies, career trajectory, educational background. Email sequences, sales calls, LinkedIn outreach, win/loss notes, call transcripts. All parsed and analyzed to create digital CFO avatars that you can message and identify which messaging angles drive action.

Pricepoint’s CFO Simulator

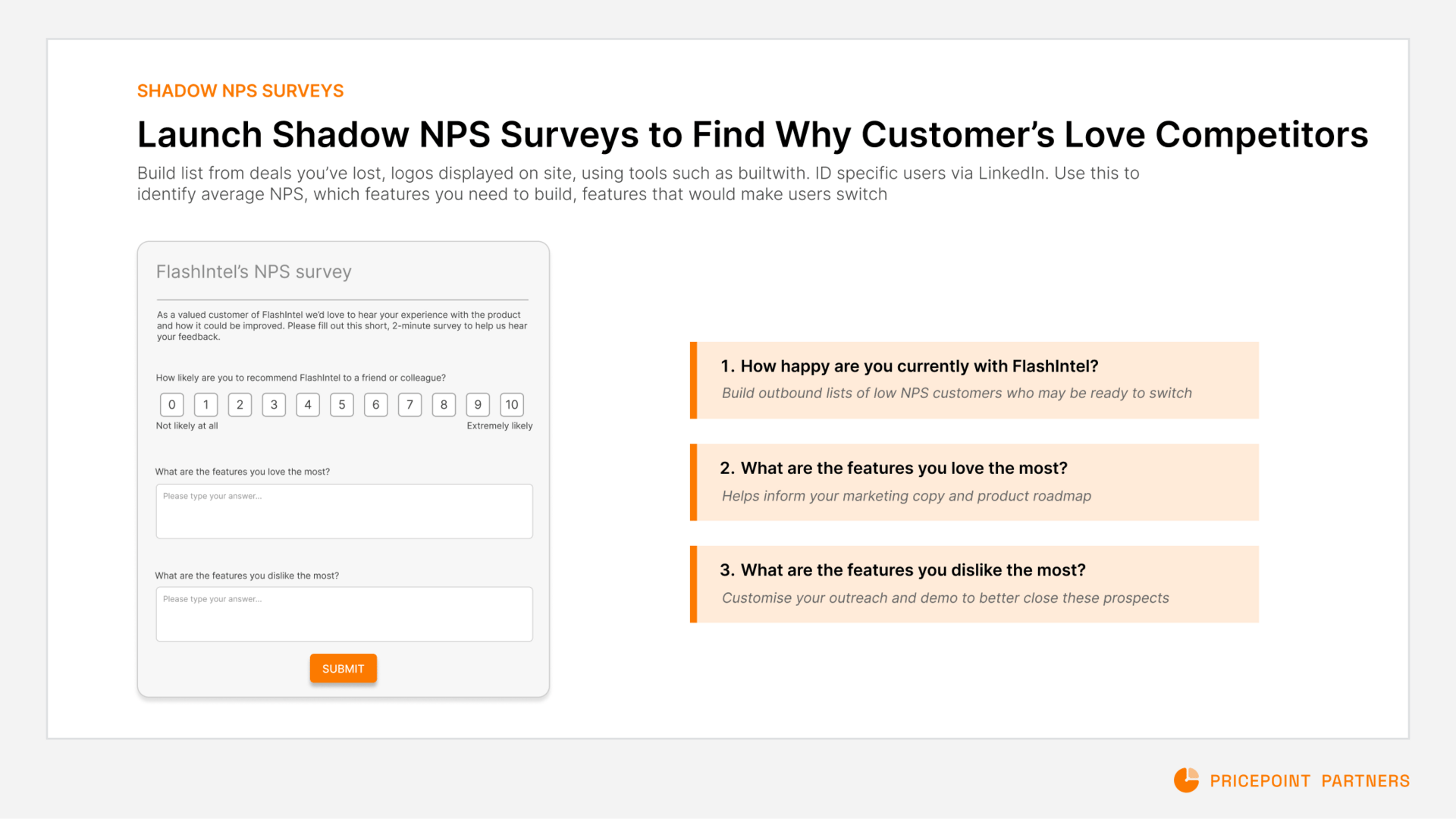

Shadow NPS Surveys: First, they work with clients to collect lists of competitor customers (from lost deals) and end users via LinkedIn. Then they send unbranded NPS surveys asking how happy customers are with "Provider X," what features they love, and what they hate. Unhappy customers become the exact language for cold email scripts and targeted advertising.

Leaked Pricepoint Sales Deck

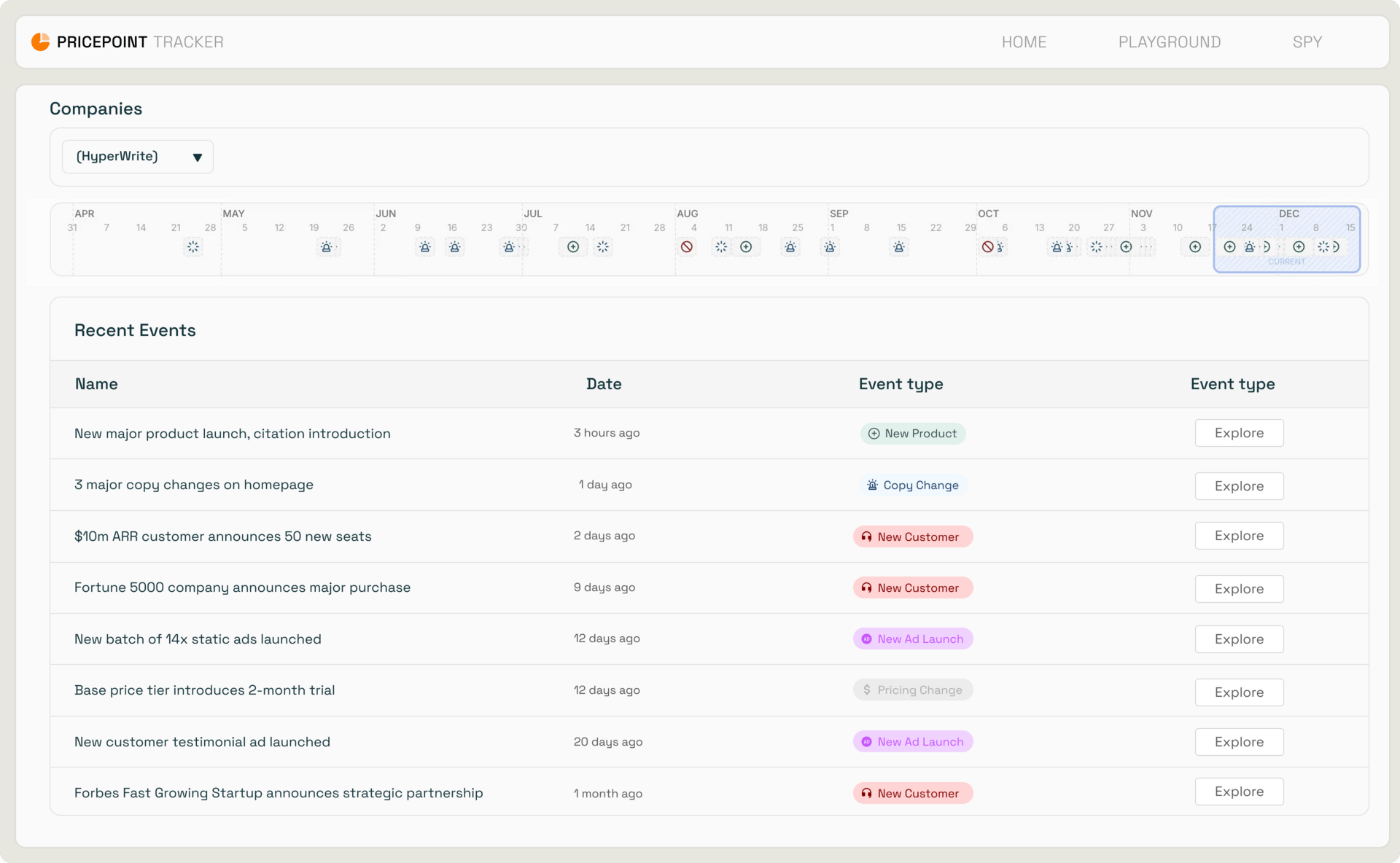

Competitor Intelligence Network: Scrapers track recent changes to competitors' pages and funnels. They collect competitors' email sequences to analyze lifecycle nurture and retention marketing. They scrape customer success pages and case studies to identify key customer logos.

Pricepoint’s Competitor Scraper

Intent Signal Monitoring: They monitor funding announcements, finance job postings, employee growth patterns, and patent applications to help customers identify high-intent prospects.

Publisher Network: They've bought and built news sites to run advertorials for clients, more credible than company blog posts and more engaging for prospects. They also use the publisher network to capture intent signals for hyper-focused outbound campaigns.

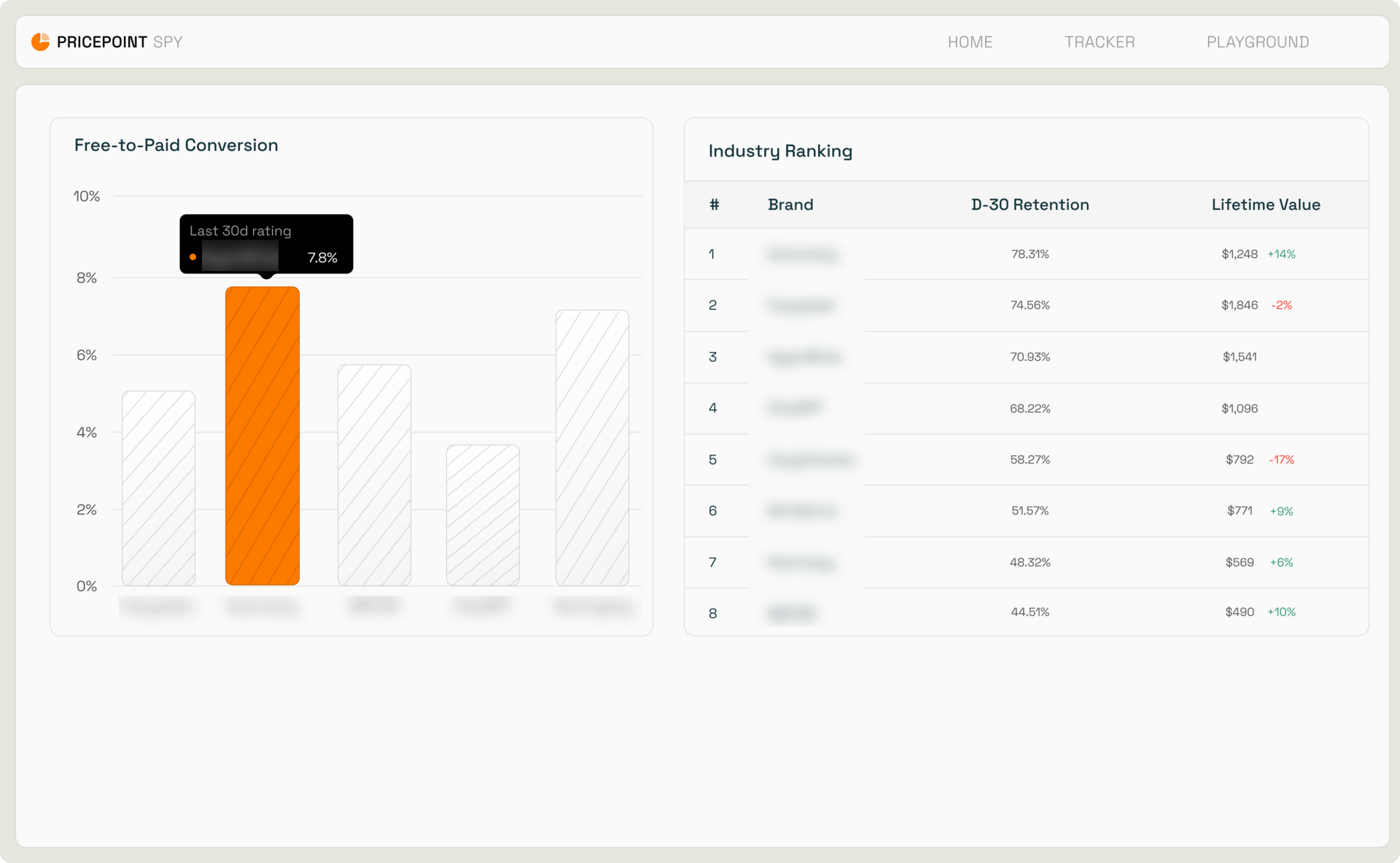

The clients I spoke with consistently mentioned getting access to data they never could have collected themselves. One client showed me competitor LTV and churn metrics that Pricepoint had somehow acquired. Another had detailed analysis of a competitor's email nurture sequences.

Competitor Churn & LTV Metrics Inside Pricepoint

Based on the clients I spoke with, this data-backed model seems to be (for the most part) highly appealing to SaaS companies who typically don't like working with consultants because traditional firms lack both the expertise and the data.

The Trade-offs of Data Dependency

But this shift from labor to data creates new dynamics that aren't necessarily better for all clients.

Traditional consulting offers clean exits. Project ends, relationship ends, no ongoing dependencies. Pricepoint's model creates ongoing data addiction.

Clients become dependent on their competitive intelligence feeds. Some clients might prefer paying $500/hour for independent thinking over monthly fees for proprietary data they can't replicate internally.

There's also a question of whether traditional consulting firms are choosing not to build these data moats because they recognize something Pricepoint doesn't: clients don't actually want to be dependent on proprietary data systems.

Why This Works (And Why Others Struggle to Copy It)

What Pricepoint has done is pair competitive intelligence software with a consulting firm. The consultants have much more rationale behind their recommendations because they're working with proprietary data that clients can't access elsewhere.

Their approach costs less than traditional consulting projects while targeting startups that larger firms can't serve profitably. They're building software tools that deliver ongoing value, but I'm not sure I'd call it revolutionary, more like logical adaptation to economic reality.

The problem, though, might be that most consulting firms are too diversified to make this transition. They have too many other commitments, too much overhead, too many partners who know other industries. Their diversification, once a strength, becomes a liability when you need to build vertical-specific data moats.

The Uncomfortable Implications

I wonder whether traditional consulting firms realize how much of their historical value was just having junior people research things really well?

When AI can handle that foundational work, what's left is either pure strategic thinking (which requires deep vertical expertise) or access to proprietary information.

Pricepoint suggests the latter might be more defensible. But it also suggests that consulting is fragmenting into smaller, more specialized pieces rather than evolving as an industry.

This feels like an important moment. Not because AI will replace all consultants, but because AI is commoditizing everything consultants used to charge premium rates for. The firms that survive won't be those that automate their thinking, could it be those that systematically build proprietary data advantages in specific verticals?

I am not saying every consulting firm should become Pricepoint. But I am saying that the old model of selling time and generic insights is clearly struggling. The question is whether established firms can transition to selling information asymmetries instead, and whether clients actually want that transition.

Based on the market reaction to Accenture and McKinsey, it seems like investors have their doubts.

Big investors are buying this “unlisted” stock

When the founder who sold his last company to Zillow for $120M starts a new venture, people notice. That’s why the same VCs who backed Uber, Venmo, and eBay also invested in Pacaso.

Disrupting the real estate industry once again, Pacaso’s streamlined platform offers co-ownership of premier properties, revamping the $1.3T vacation home market.

And it works. By handing keys to 2,000+ happy homeowners, Pacaso has already made $110M+ in gross profits in their operating history.

Now, after 41% YoY gross profit growth last year alone, they recently reserved the Nasdaq ticker PCSO.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.