- Tech Rundown

- Posts

- 🔥📉 ChatGPT Is Stealing Your Traffic

🔥📉 ChatGPT Is Stealing Your Traffic

Vercel gets 20% of signups from ChatGPT now

Kleiner Perkins, Nvidia, Sequoia, and Khosla Ventures just wrote a $35 million check to Profound, a startup that helps brands rank in ChatGPT. This isn't remarkable because of the amount, it's remarkable because they did it together.

This coordinated kingmaking play is becoming a pattern. Pick one company in a new category, flood it with capital from multiple tier-1 firms, blast out press releases, make intros to portfolio companies to juice early revenue, and watch competitors struggle to raise. It's happened with Harvey in legal AI, Cursor in coding, ListenLabs in UX research, and now Profound in what's being called "generative engine optimization" or GEO, basically SEO, but for AI chatbots.

The logic is straightforward: in uncertain markets, create certainty through coordination. When three or four brand-name VCs back the same company, it signals "this one won" before the market has even formed. Other startups find it nearly impossible to raise because investors don't want to compete with a kingmade company. The first-mover gets a brand moat before they've proven much of anything.

Whether this works depends entirely on whether the underlying market is real. And that's where things get interesting.

The Shift Is Actually Happening

The traffic migration from Google to ChatGPT isn't speculative anymore. The numbers are starting to show up in real company metrics.

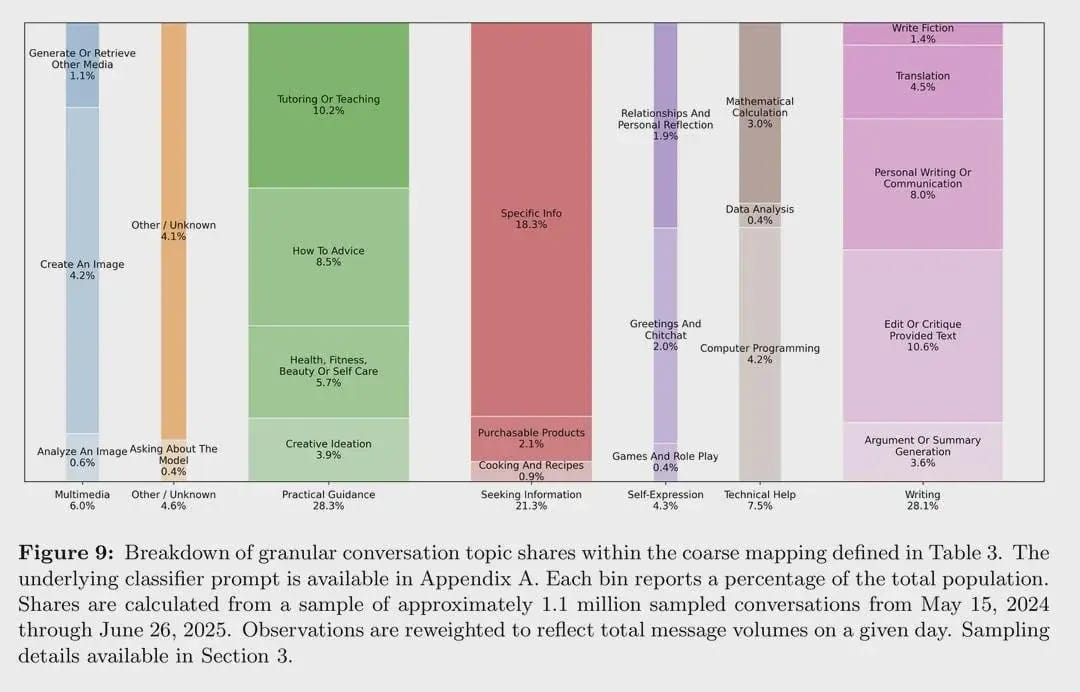

ChatGPT hit 800 million weekly active users. That's not just people asking it to write poems. A meaningful chunk of those queries are commercial—the kind of "best project management software for startups" or "which CRM should I use" searches that would normally happen on Google and get monetized through ads or SEO.

Vercel, the deployment platform, now sees 10% of all traffic and 15-20% of signups coming from ChatGPT. Eighteen months ago, 0.02% of images uploaded to Canva came from ChatGPT referrals. Today it's 5%—a 250x increase. Dharmesh Shah, founder of HubSpot, says organic SEO traffic is down 20-40% due to AI tools like ChatGPT.

This is not noise. This is a genuine platform shift, the kind that happens maybe once a decade. Google drove $2.4 trillion in commerce last year. The bull case for GEO says that within five years, $1 trillion of that shifts to ChatGPT and similar AI assistants. If you're a business that generates meaningful revenue from SEO, you're facing a distribution channel that's quietly evaporating.

So what happens when brands realize they need to rank in ChatGPT the same way they needed to rank in Google? A bunch of startups show up claiming to solve the problem.

What GEO Tools Actually Do (And Don't Do)

Here's how these platforms work: they run thousands of simulated prompts through ChatGPT, Gemini, Claude, or Perplexity. If your brand gets mentioned in the response, they log it as a "ranking." They track which prompts surface your company, how often you appear, what sentiment the model expresses, and who your competitors are in the same responses.

The idea is to create a dashboard—similar to Ahrefs or Semrush for SEO—that shows your brand's "AI visibility." You can see which queries mention you, which don't, and theoretically adjust your content strategy to improve those mentions.

The problem is that these tools are measuring simulated data, not real behavior. They're asking ChatGPT the same questions over and over and tracking the answers. But that's not the same as seeing server-side data about what real users ask or what ChatGPT actually crawls.

Simulated prompts don't tell you:

How AI bots actually interact with your site

Whether your content is being crawled or ignored

If citations are hidden or visible

Whether AI-driven mentions translate to traffic

You're getting a performance, not a recording. This matters because when the platform changes its algorithm, which it does, constantly. Your simulated data doesn't tell you what broke or why.

The Grey Hat Gold Rush

Because this is a new space with real money sloshing around and no clear rules, it's attracted every growth hacker, SEO optimizer, and content farmer looking for the next arbitrage opportunity.

There are now dozens of services making millions by using AI to create endless streams of blog posts for customers, ostensibly to help with SEO and GEO. They're growing fast by virtue of making the internet worse. The same enshittification that degraded Google search results is now hitting AI training data before these models have even figured out how to filter it.

The Meridian launch is a perfect example. Meridian is another GEO tool that launched recently by making scare-tactic claims that weren't entirely true—basically fake statistics designed to panic companies into adopting their platform. They paid large DTC influencers like Nick Shackleford to promote the product, even though it's unlikely these influencers had used it at all, let alone for more than a week or two.

The comment sections on those promotional posts filled up with bots, accounts leaving generic praise that have previously pushed crypto scams. It was a launch that looked successful if you squinted, but up close it was mostly theater.

When the Platform Pulls the Rug

The core vulnerability of GEO isn't just that the tools measure fake data—it's that brands are building strategies on platforms that have zero obligation to maintain any ranking system.

Take the Reddit stuffing example. A bunch of GEO companies realized that OpenAI and Google's Gemini had done strategic deals with Reddit and were treating Reddit content as high-quality, authentic, human-driven recommendations. So naturally, brands started flooding Reddit with mentions. It worked for a while, Reddit links showed up constantly in ChatGPT responses.

Then ChatGPT changed how it scraped Reddit. Overnight, the number of Reddit citations dropped off a cliff. All those brands that had invested in Reddit strategies saw their AI visibility vanish. No warning, no explanation, no appeal process.

Or consider Ramp and Profound's partnership, held up as an example of GEO done right. They went from 12,500 keywords ranking in the top 3 of Google to 7,000 after Google's spam update finished rolling out in September. The AI-generated content that powered their rankings got flagged as spam.

AI slop works until it doesn't. And when it stops working, it happens fast and without recourse.

This is platform dependency on steroids. When Google changed its algorithm, at least you still had 10 blue links and could see where you ranked. You had some visibility into the system. With ChatGPT, you get nothing. There's no ranking page, no appeal, no transparency. The model either mentions you or it doesn't.

The Facebook Video Parallel

We've seen this movie before. Remember when Facebook told publishers to "pivot to video"? The platform heavily promoted video content, the data looked great, and media companies fired writers to hire video producers. Then Facebook quietly pulled back on video distribution. Companies that had restructured their entire operations around Facebook's signals were suddenly facing collapse.

The GEO rush has the same structure, but it's arguably worse because the feedback loop is even more opaque. Facebook at least gave you analytics. ChatGPT gives you... whatever it feels like giving you, based on training data you can't see, sources it won't reveal, and ranking signals that change without notice.

If ChatGPT decides tomorrow that it wants to prioritize different sources, or change how it weights brand mentions, or simply stop citing third-party content as often, then every GEO strategy built today becomes worthless.

And your GEO tool won't tell you why, because it's been measuring simulations the whole time.

The Bear Case Nobody Wants To Hear

Here's the uncomfortable question: why would GEO produce venture-scale returns when SEO never did?

It spawned an entire industry (Ahrefs, Semrush, Moz, Similarweb) and none of them became monopolistic winners. The market stayed fragmented. Each tool carved out a niche (backlinks, traffic monitoring, keyword research), but nobody captured the full stack. The work was distributed across agencies, in-house teams, and freelancers. Data was messy, rankings were inferred, and Google held all the actual keys.

The bull case for GEO says this time is different because AI platforms allow vendors to "shape both the data and the interface" in a way Google never permitted. But that thesis requires these platforms to give startups meaningful access and control, which they have no incentive to do.

There are already 12-20 startups claiming to be the "first" GEO tool, all using essentially the same approach: simulate queries, track mentions, package it in a dashboard. That's not a sign of a winner-take-all market. That's a sign of rapid commoditization.

And commoditization is happening faster than ever. SEO took a decade to fragment into specialized niches. GEO is speedrunning the entire lifecycle. If everyone can build the same tool in six months using the same public APIs, where's the moat?

The kingmaking strategy makes sense if you believe there's a massive market that just needs a champion. But what if you're manufacturing market leadership in a category that's already commoditized, built on simulated data, vulnerable to platform changes, and structurally similar to a market (SEO) that never produced the returns everyone's chasing?

What This Means

The shift from Google to ChatGPT for commercial queries is real. The Vercel and Canva numbers don't lie. But the tools being built to capitalize on that shift are vulnerable to platform changes they can't predict or control. They're attracting grey hat operators who are degrading the very systems they're trying to game. And they're entering a market that historically didn't produce venture-scale winners, now with even faster commoditization.

VCs are making coordinated bets because in the AI era, maybe you can't afford to wait for clear signals, if ChatGPT changes its monetization strategy or ranking approach, the entire opportunity could evaporate before you've invested. So you kingmake early and hope the market solidifies around your pick.

But kingmaking works best when you're crowning a winner in a race that's actually happening. It's less clear what happens when you're manufacturing a champion for a competition that might not have a finish line.