- Tech Rundown

- Posts

- 🤖💔 Free AI Is Dying. Here's Who Plans to Save It

🤖💔 Free AI Is Dying. Here's Who Plans to Save It

Two weeks after launching, VCs are throwing money at AI's monetization problem

Ryan Hudson sold Honey to PayPal for $4 billion in 2020: more than PayPal paid for Venmo ($800M), Braintree ($800M), Xoom ($890M), Hyperwallet ($400M), TIO Networks ($238M), Paydiant ($280M), Simility ($120M), CyActive ($60M) combined. For a browser extension that applies coupon codes.

The browser extension that automatically finds coupon codes at checkout was, depending on your perspective, either a consumer champion or a parasitic middleman inserting itself into e-commerce transactions. Now Hudson is back with a team of 30 Honey alumni, and after a brief detour through ad blocking, they're building what might be the most important infrastructure nobody's heard of: the advertising layer for AI.

The company is called ZeroClick, and it emerged from stealth three weeks ago with a $55 million Series A. Several growth funds have already offered terms for a preemptive $100 million Series B. The speed of fundraising tells you something about either the quality of the idea or the track record of the founder. Probably both.

From Honey to Pie to AI

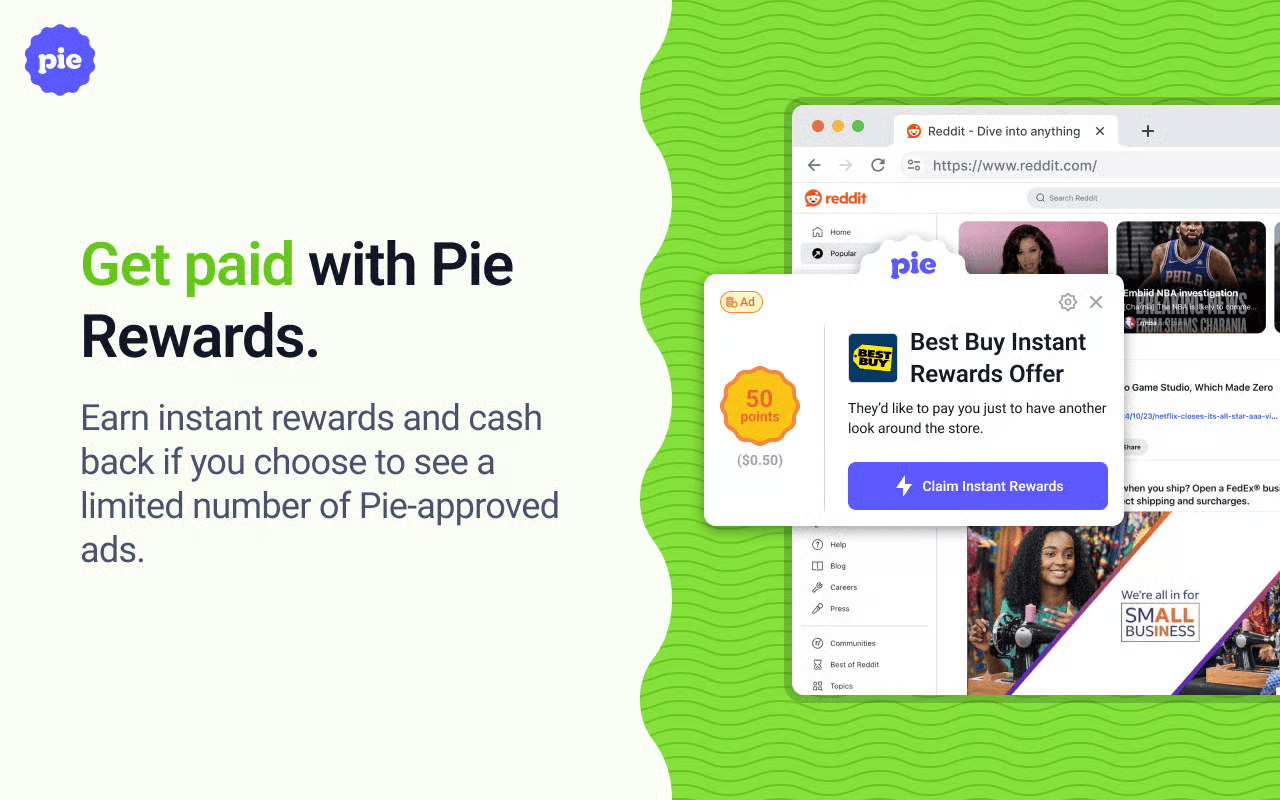

Hudson's path to ZeroClick started with Pie, an ad blocker that launched with a simple premise: "Block ads, get paid." Unlike the typical ad blocker built by programmers for programmers, Pie's mainstream consumer UX attracted 500,000 downloads in its first two months through a massive YouTube ads campaign. The product now has over 2 million users.

The philosophy behind Pie was revealing. As Hudson put it: "The advertising world is broken and I see a way that we might be able to fix it by putting users in control. Ads and privacy are fundamentally broken because they ignore the user in the equation. It is a deal between a publisher and an advertiser and the user has no say."

But Pie was more than just another ad blocker. The team built a contextual ad system that could match advertiser opportunities with webpage content in a privacy-native way, with all profiling happened in the browser and never leaving it. They wanted to give users precise controls over which ads they saw and reward them for opting in. The technical infrastructure they built for this turned out to be, as Hudson realized, "highly applicable to the world of AI."

So they pivoted. Two million users is, as Hudson admits, "dramatically sub-scale for an ad system." But the technology they'd built, the ability to match advertising context in a privacy-preserving way, had found its killer use case.

The Stripe for AI Advertising

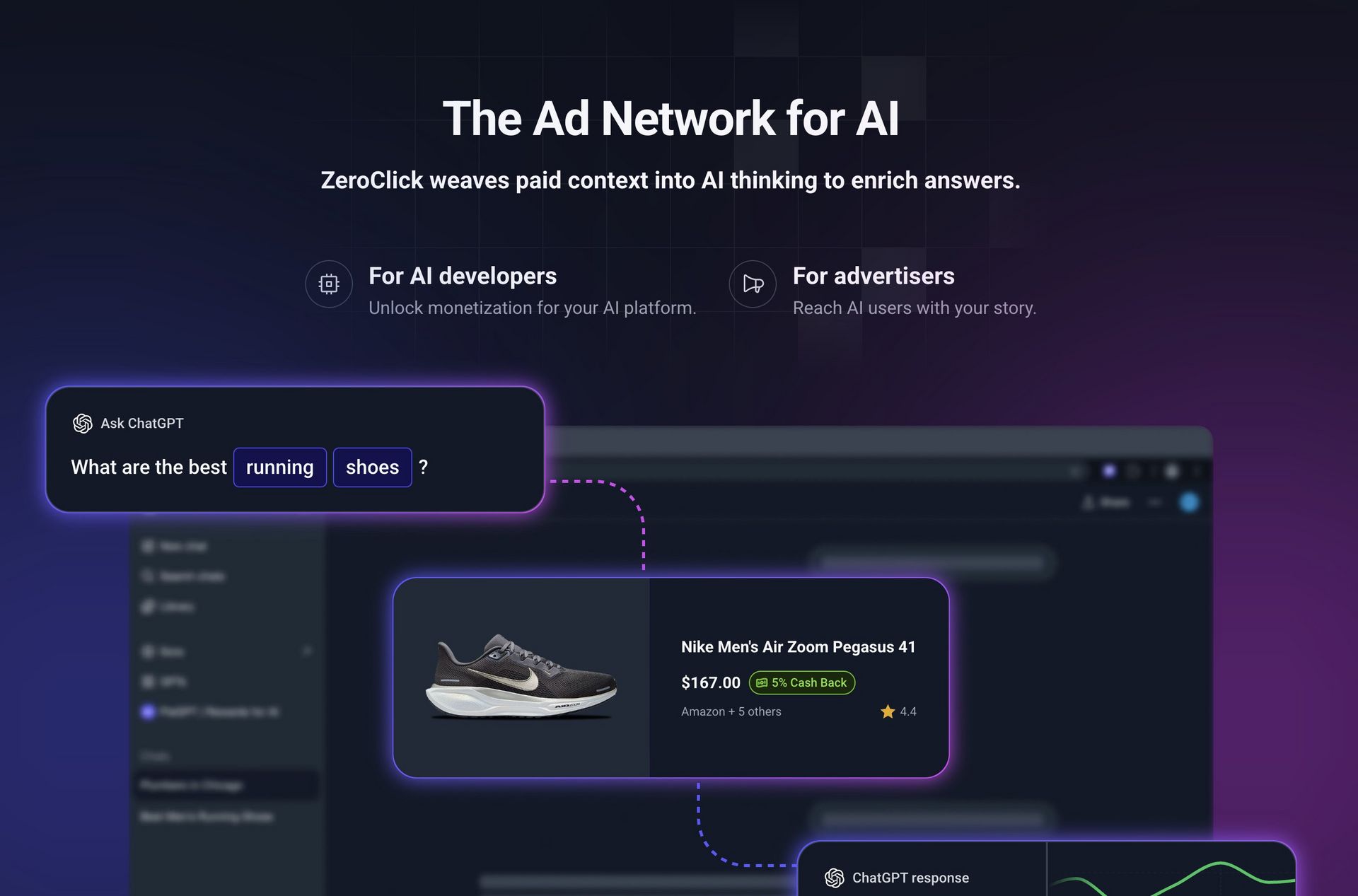

ZeroClick's core product is what they call a "native advertising platform for AI systems." The pitch is simple: they want to be the Stripe for AI advertising, providing common rails that enable developers to integrate monetization without building their own ad systems.

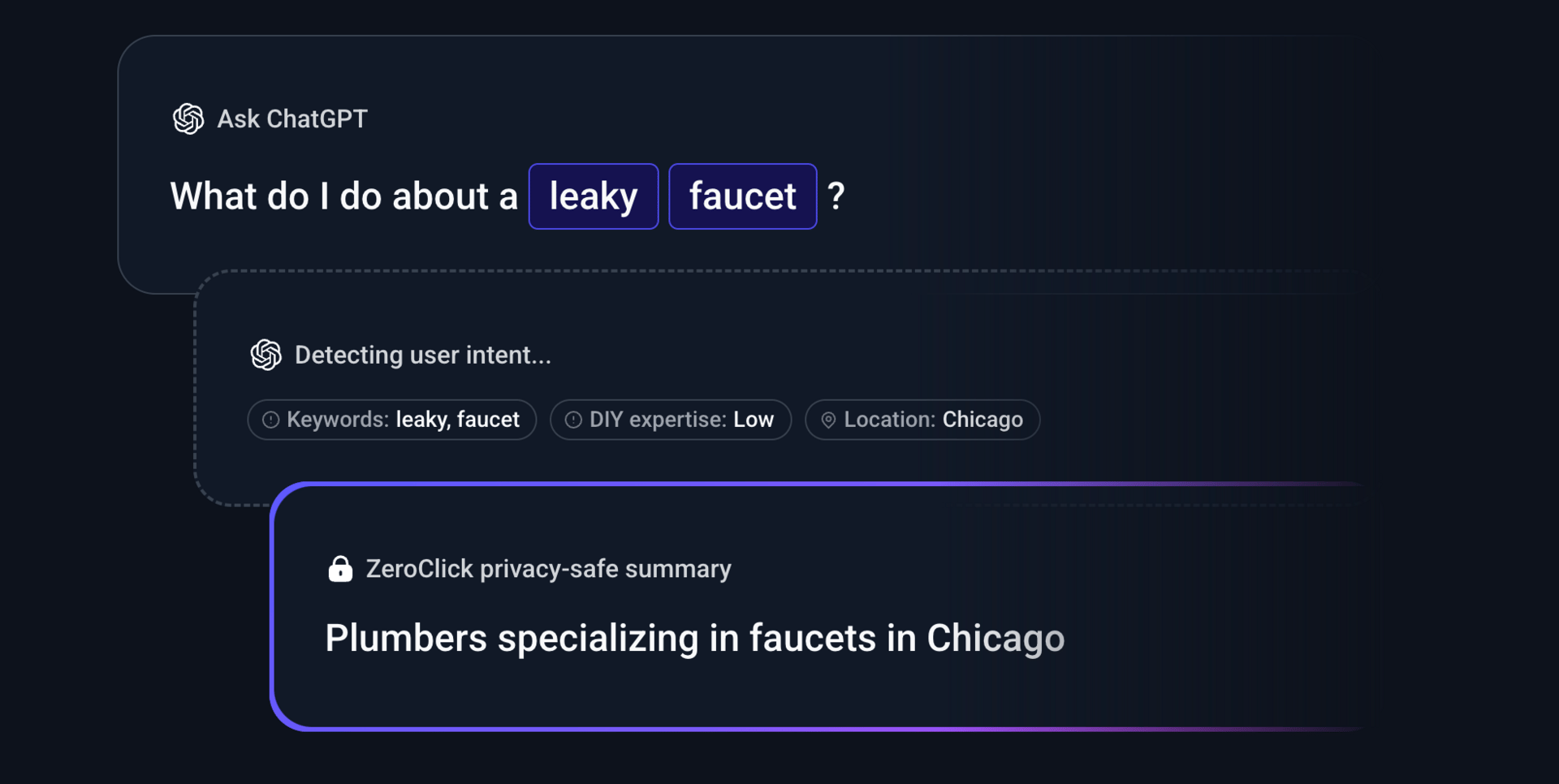

Here's how it works, when an AI system processes a query, ZeroClick can inject relevant advertiser content during what they call "reasoning time". The AI considers this additional context and, if relevant, includes it in responses with trackable links.

The technical implementation is surprisingly elegant. They take advertiser context (landing pages, product catalogs, service databases) and use AI to generate ad campaigns automatically. These get mapped in vector space to match against queries. Advertisers don't need to think about keywords or campaign creation; the system handles it for them.

Early results from their Pie GPT reference implementation show "insanely high" click-through rates. Users are actually clicking through from AI responses at rates that suggest the ads are genuinely useful rather than intrusive. Though as Hudson cautiously notes, "It's early numbers on that, and it's a certain type of audience."

The $30 Billion Question

The opportunity Hudson sees isn't in competing with Google or OpenAI for search revenue. The potential market for that is concentrated among players who will likely build their own monetization. Instead, ZeroClick is betting on the long tail. The millions of specialized AI applications that will need monetization but can't justify building their own ad systems.

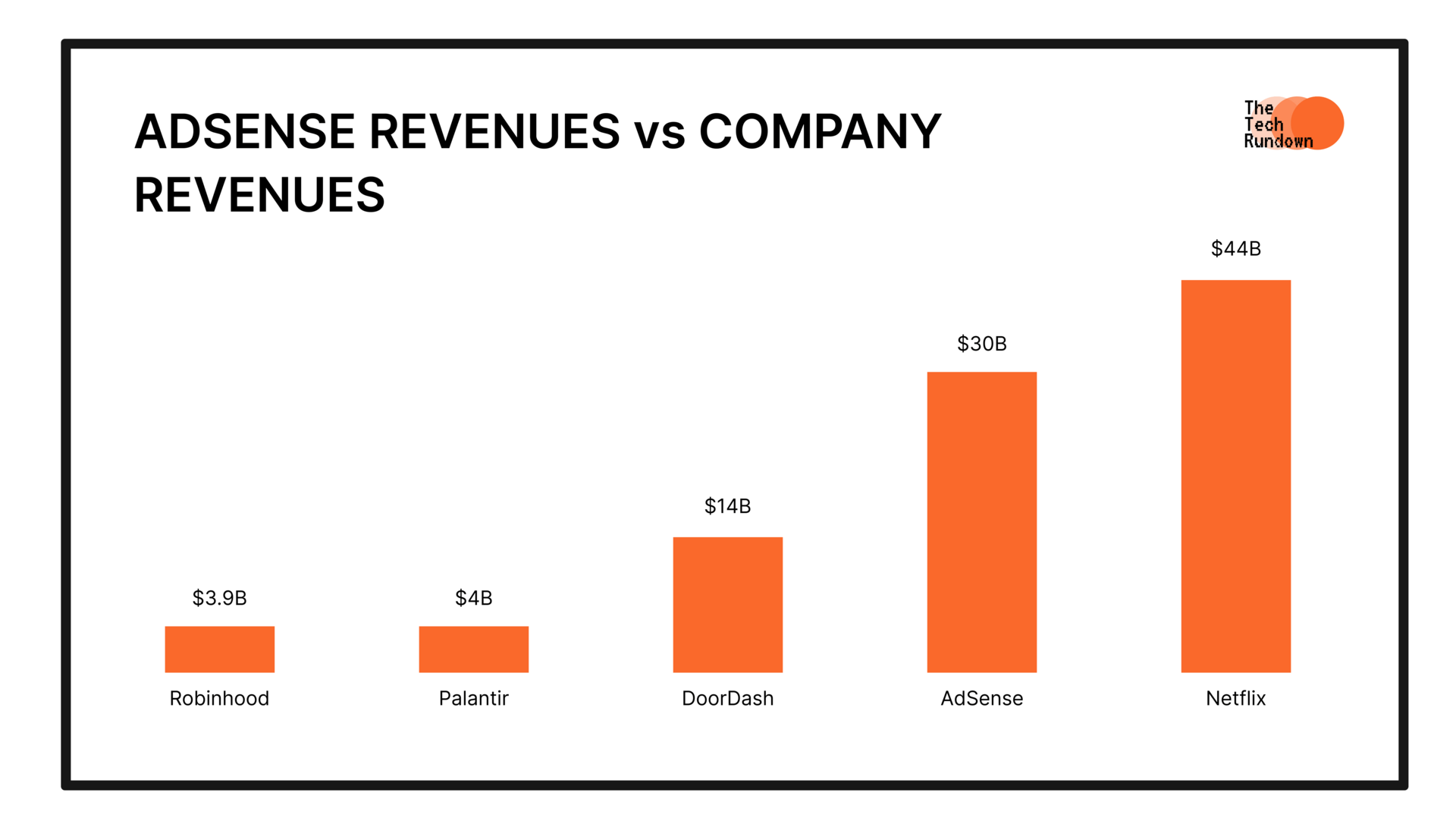

It's essentially the AdSense model (where you can put Google Ads on your website) but for AI applications. Google's Network revenue (primarily AdSense) generated $7.5 billion in Q3 2024 - smaller than the $49 billion from Google Search, but still a $30 billion annual business. In the AdSense model, Google keeps 30% and publishers get 70% of revenue. ZeroClick is positioning itself for a similar split in the AI ecosystem.

The economics are compelling for AI developers. Right now, most AI tools convert around only 3% of free users to paid subscriptions, the other 97% are pure cost. To put this in perspective: if ChatGPT's 700 million weekly users are each generating just $1 in inference costs per month, that's $8.4 billion annually being lit on fire on non-paying users. That's twice Pinterest's entire annual revenue ($3.9B), nearly double Snapchat's ($4.7B), and 8x what Uber makes from its entire advertising business. Ad monetization could transform these users from cost centers into revenue generators.

More fundamentally, free ad-supported businesses have always had bigger potential than subscription models. There's a reason the largest digital services (Google, YouTube, Facebook, Instagram, Gmail, Maps) are all free and ad-supported. Most people simply aren't willing to pay for subscription products. The $20/month price point that's become standard for AI tools immediately excludes the vast majority of potential users. Ad support doesn't just monetize existing free users; it expands the total addressable market by orders of magnitude.

Consider Cursor's free tier. Right now it's burning money on every free user. But companies wanting to reach developers setting up coding projects; hosting providers, infrastructure companies, database vendors, AI model providers would theoretically pay to advertise to these users. When someone asks Cursor to set up a project, it could recommend the best tools while generating revenue.

Or take OpenEvidence, an AI chatbot trained specifically for doctors to help them handle edge cases in treating patients. Physicians need to stay current with thousands of medical papers published weekly, which is humanly impossible. OpenEvidence gives them an AI assistant that can surface relevant, up-to-date medical literature instantly. The audience value is obvious, pharmaceutical companies and medical device manufacturers would pay premium rates to reach physicians.

The Distribution Problem

The age-old venture capital question "what if Google copies your product?" actually holds water here. At $30 billion in annual revenue, the AI ad network opportunity is bigger than the revenues of DoorDash, Robinhood, or Palantir. It's almost Netflix's total annual revenue. Google would defend this like a medieval castle.

Google's defensibility comes from its flywheel: more users attract more advertisers, which enables better ad matching and higher revenues, which improves user experience, which attracts more users. Reports suggest over 38 million websites use AdSense. They also already have relationships with over 1.2 million businesses using Google Ads. If each advertiser relationship took just one hour to establish and maintain annually, that's 137 years of continuous work. Good luck replicating that with a 30-person team from a browser extension company.

Hudson knows this history. Overture (originally GoTo.com) pioneered the pay-per-click model and self-service bidding system in 1998. Google adopted a similar model with AdWords in 2000 and ultimately won through superior search technology and scale. The lesson: having the idea isn't enough; execution and distribution matter.

The Browser Extension Angle

There's something particularly interesting about Hudson's continued fascination with browser-based applications. The Honey team understands browser real estate better than almost anyone, they built a $4 billion business on it.

Hudson sees opportunities beyond chat interfaces: "If you're on a product page browsing something on Amazon, wouldn't you like to know if there's a deal somewhere else?" A browser extension with AI could reference Honey's decade of price history data, telling users whether something is genuinely on sale or overpriced. This isn't about users copying URLs into ChatGPT, it's about AI appearing contextually where commerce happens.

Corporate workflows, email, meeting notes. Hudson envisions AI everywhere, not just in monolithic platforms. If you're discussing marketing strategy in a meeting, the AI could recommend tools, providers, or agencies. The contextual, ambient nature of these interactions is what makes them valuable for advertisers.

The New Competitive Dynamic

Perhaps most intriguingly, ZeroClick could enable entirely new competitive dynamics in software. Much like product-led growth disrupted sales-led SaaS by dramatically lowering customer acquisition costs, ad-supported AI could create new GTM strategies and business models that weren't previously viable.

This isn't necessarily about disrupting existing B2B SaaS, those products require support, compliance, and security that justify their costs. But it could enable new GTM strategies and business models that weren't previously viable. Free, ad-supported AI tools could expand markets in the same way that Google, YouTube, Facebook, and Instagram did by being free.

The bet Hudson is making is that the AI ecosystem won't be monolithic. As he puts it, he hopes for a "wide distribution of a long tail of millions of AI developers and publishers that are building compelling use cases for different people with AI." In that world, someone needs to provide the monetization infrastructure.

Apple silicon will soon enable local language model processing equivalent to today's cloud models. Developers will build applications and all of them will face the same question: how do you monetize free users when inference is expensive?

Hudson thinks he has the answer. "In the next six months to a year, hopefully, people think of ZeroClick as the way to monetize their free tier with ads and plug into these rails." It's the same playbook as Stripe - own the boring but essential infrastructure that everyone needs but nobody wants to build.

The philosophy hasn't changed from his Pie days: "We can make ads good, actually." Coming from someone who built a $4 billion business inserting himself between users and e-commerce, that might sound ironic. Or maybe it's the right background for the job.

How 433 Investors Unlocked 400X Return Potential

Institutional investors back startups to unlock outsized returns. Regular investors have to wait. But not anymore. Thanks to regulatory updates, some companies are doing things differently.

Take Revolut. In 2016, 433 regular people invested an average of $2,730. Today? They got a 400X buyout offer from the company, as Revolut’s valuation increased 89,900% in the same timeframe.

Founded by a former Zillow exec, Pacaso’s co-ownership tech reshapes the $1.3T vacation home market. They’ve earned $110M+ in gross profit to date, including 41% YoY growth in 2024 alone. They even reserved the Nasdaq ticker PCSO.

The same institutional investors behind Uber, Venmo, and eBay backed Pacaso. And you can join them. But not for long. Pacaso’s investment opportunity ends September 18.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.