- Tech Rundown

- Posts

- 🔥 Google's Plan to Bury OpenAI in Cheap Tokens

🔥 Google's Plan to Bury OpenAI in Cheap Tokens

Why Google's ad revenue hasn't slowed yet, and when it might

Google announced Nano Banana Pro this week, which is a major upgrade to their image generation capabilities. Better text rendering, advanced editing controls, web search built in, consistent person rendering. It's built on Gemini 3 and rolling out across basically everything Google touches: the Gemini app, Search, Workspace, NotebookLM, Flow, and the API.

This is, on its surface, a product announcement. But I think it's more interesting as a case study in how Google has decided to win the AI race, and what that means for everyone else, particularly OpenAI.

The Cost War

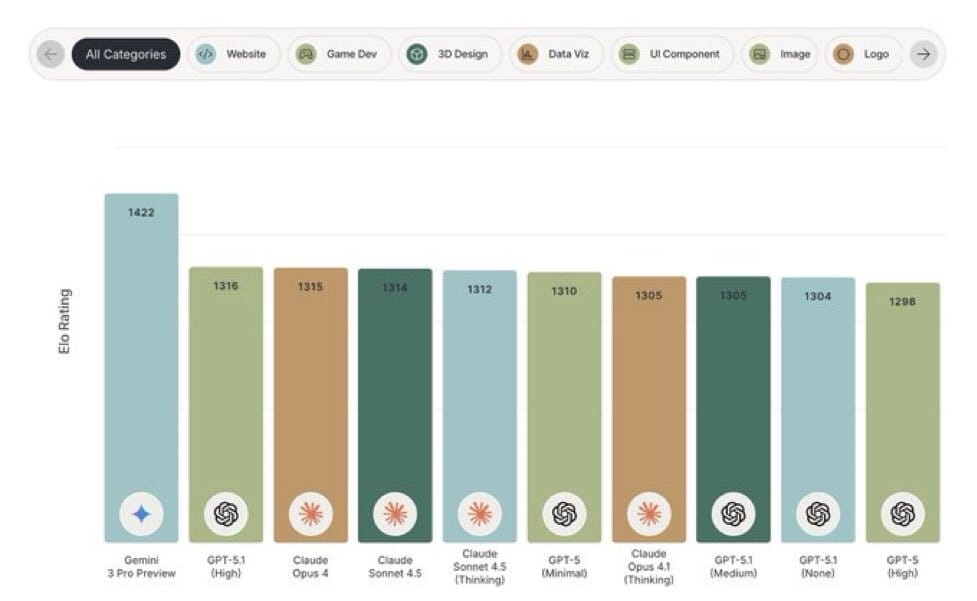

The conventional narrative about AI competition goes something like: whoever builds the best model wins. This made sense when GPT-4 was meaningfully better than everything else. It makes less sense now. Anthropic released Claude 4.5 Opus (their best coding model) and OpenAI released GPT 5.1 in the same week. The gaps between frontier models are measured in vibes and benchmark points, not in "one can do this and the other can't."

When your product is commoditizing, you have two choices: differentiate on something other than the core product, or win on cost. Google is doing both.

The cost part is the less appreciated story. Google has been building TPUs, their own custom AI chips, for years. Google now has a structural 4-6x cost advantage per inference token compared to companies running on Nvidia hardware.

Microsoft and OpenAI are locked into multi-year Nvidia capex commitments. They cannot match Google's pricing without destroying their margins. Google can keep cutting token costs and passing the savings through to Cloud pricing, and there's not much anyone can do about it.

The strategy, if you want to be uncharitable about it, is: bury all competing foundational models in negative gross margin tokens for eternity, forcing the other companies to dilute their equity into oblivion.

If you want to be charitable, it's: Google is trying to win AI by making compute cheap, not by beating Nvidia on raw speed.

Either way, the result is the same. If inference becomes 90% of AI spend (which it will, as models mature and training becomes less frequent) the winner is whoever offers the lowest cost-per-token at scale. Google's bet is that this is them.

The Distribution Part

But cost is only half of it. The other half is distribution, and here Google has an advantage that's hard to overstate.

The company that effectively owns the Android OS on 70% of the world's phones is releasing Gemini on them, mostly for free. OpenAI doesn't own the phone business. They don't own the browser. They don't own the search engine. They don't own the productivity suite.

This is the Netscape problem. In the 1990s, Netscape had the best browser. Then Microsoft bundled Internet Explorer with Windows, and Netscape went from 80% market share to irrelevance in about three years. It didn't matter that Netscape was, for a while, the better product. Microsoft owned the distribution layer.

OpenAI knows this, which is why they're launching a hardware device with Jony Ive and have released their own browser (Atlas). They're trying to own more of the stack. But building a hardware business from scratch while Google is shipping Gemini to billions of existing Android users is... a lot.

In another sign that Google has gotten its act together, they've become much better at consumer marketing. The NotebookLM launch went viral. Now they're implementing growth hacks for Nano Banana Pro.

The playbook is borrowed. When ChatGPT's image generation went viral, it was because people were posting Studio Ghibli-style portraits on Twitter and Instagram. Google followed suit — get people posting these complex AI-generated graphics, and the product markets itself.

They've also adopted a mechanic pioneered by Grok on Twitter: you can tag the AI in a post and get a response. The brilliance of this is that it's not private. The response appears in everyone's feed. It's free distribution disguised as a feature.

This is the kind of thing Google historically has been terrible at. The fact that they're doing it now suggests someone over there is paying attention.

OpenAI's Position

So where does this leave OpenAI?

Sam Altman has said they're facing "economic headwinds" despite impressive growth. CFO Sarah Friar has said time spent in the app has decreased recently. They're losing market share in the enterprise API business to both Google and Anthropic.

This sounds bad, but I'm not sure it's fatal. When people think of AI, they think of ChatGPT. That brand association is enormously valuable and very hard to dethrone. Google has better distribution and lower costs, but Gemini doesn't have the same consumer mindshare.

The question is what OpenAI should do with that brand.

The Consumer Pivot

Here's a contrarian take: OpenAI should stop trying to win the frontier model race and focus on the consumer business.

They've struggled to launch breakout secondary applications. Their meeting note recorder didn't take off. The original Sora (video generation) had limited impact. The successes have been Sora as a social app (a more recent evolution with video generation built in), and Codex, their AI coding tool. But the core ChatGPT consumer product remains the thing people actually use.

The interesting part about consumer AI is that the moats are somewhat inverted from enterprise. In coding and enterprise deployments, it's a pure cost game. Businesses will happily switch to a model that's 5% better or 5% cheaper. There's no loyalty. The switching costs are minimal.

But in consumer, OpenAI has seen something unusual: parasocial attachment. When they changed ChatGPT 4o, people were upset. Some were reportedly crying. They'd built emotional relationships with the AI. That's not something you can replicate with a lower token cost.

This strategy would also be less capital intensive. Instead of investing massive amounts into training frontier models and building data centers, OpenAI becomes a product company. The goal shifts from "build the best model" to "build the most addictive and best monetized products."

The Subscription Ceiling

The problem is that consumer subscriptions have a hard ceiling.

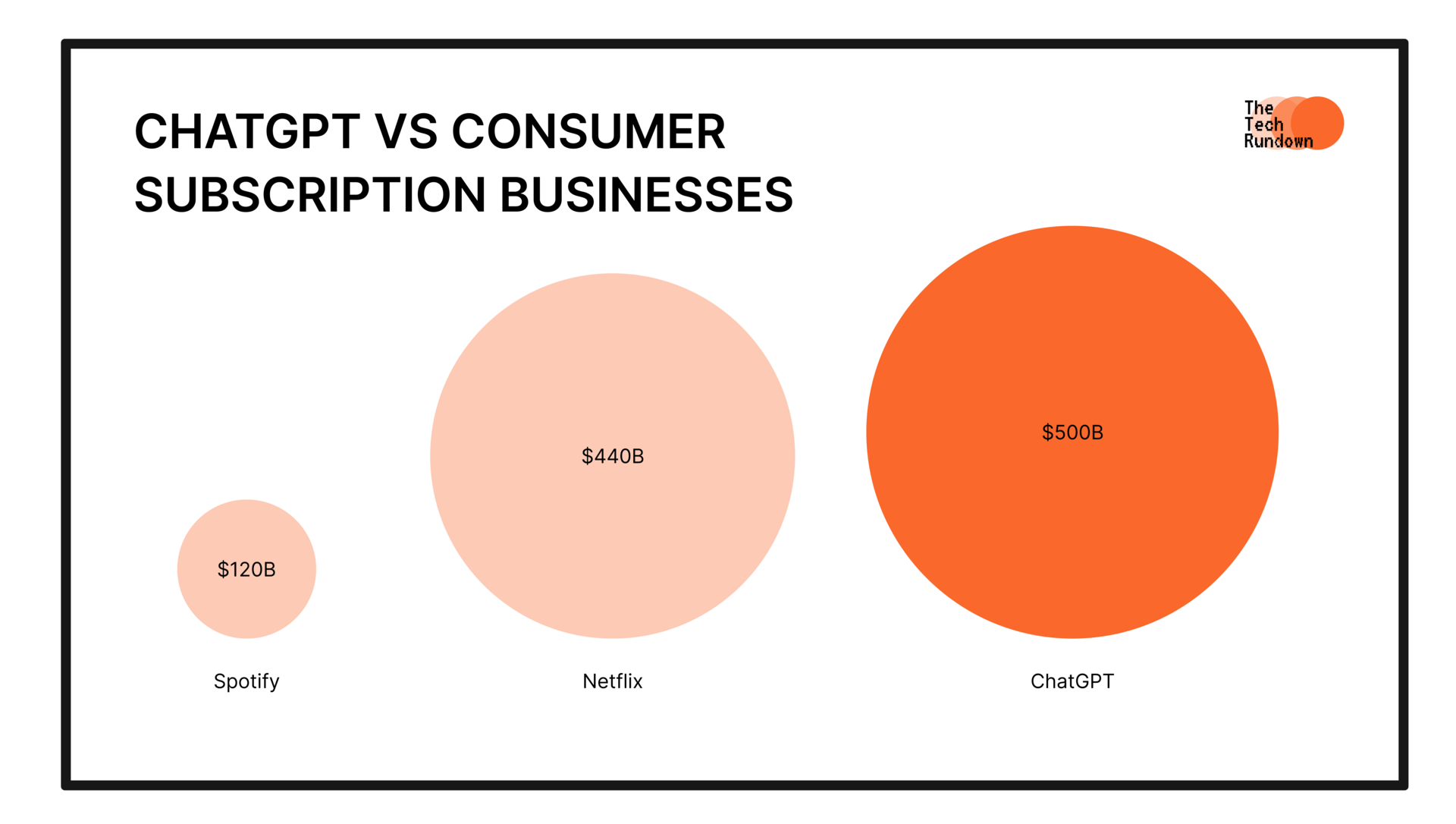

The largest consumer subscription businesses in the world are Netflix ($443B market cap) and Spotify ($120B). OpenAI is currently valued at $500B — more than Netflix, despite having less revenue and fewer subscribers. Consumer subscription businesses are fundamentally limited because there just aren't that many people willing to pay a recurring fee.

ChatGPT Valuation vs Other Consumer Subscription Companies

We're already seeing this play out. OpenAI has launched cheaper plans in India (ChatGPT Go) and dozens of other lower income countries. They're running free trials for the first time. Subscription revenue has slowed in Europe. Only about 5% of free users convert to paid — and unlike traditional software, AI has massive compute costs to serve those free users.

ChatGPT Revenue in Europe Has Slowed

Every large consumer business measured by users and revenue: Facebook, YouTube, Google, Instagram are all ad-supported, not subscription-based.

The Ad Opportunity

Which brings us to ads.

OpenAI arguably has better intent data than Google. When you're buying something, you share more intimate reasoning with ChatGPT than you would in a Google search query. You explain why you want it, what your constraints are, what you're worried about. That's extremely valuable information for advertisers.

Here's some rough math: A Google weekly active user generates about $61 per year in revenue for the company. If OpenAI could make even half that ($30 per weekly active user) with 900 million weekly active users, that's $27 billion in additional revenue on top of their $13-20 billion consumer subscription business. At a 10x revenue multiple (roughly what Google trades at), that puts OpenAI's valuation at $400-475 billion. Add in the optionality of the Jony Ive hardware device, and the current valuation starts to look less crazy.

The Dog That Hasn't Barked

One thing I find interesting: we haven't seen a slowdown in Google's ad business yet.

The theory was that AI would eat search, and search is how Google makes money. But Google's ad revenue keeps growing. Why?

One possibility is that the demand erosion is real, but the supply has nowhere to go. ChatGPT is taking queries away from Google, but advertisers can't redirect their budgets to ChatGPT because OpenAI doesn't have a real ad program yet.

If that's true, then the cracks in Google's business will only become visible when OpenAI rolls out robust self-serve advertising. At that point, advertisers may reallocate some budget away from Google, and it will finally show up in the financials.

I don't think this will be massive immediately. But it's worth watching.

The Strategic Logic

What Google is doing here has a name in strategy circles: commoditizing your complements.

The idea is simple. If you make fat margins on one thing, you want everything adjacent to that thing to be as cheap as possible, because that increases demand for your profit center. Google makes money on ads. AI models are a complement to ads, they're what people use instead of (or alongside) search. If AI models are expensive, fewer people use them, and Google's ad business is threatened. If AI models are cheap (or free) more people use them, and Google can serve ads against that usage.

So Google is willing to sell AI at cost, or even at a loss, because it protects the ad business. Microsoft and OpenAI can't do this because AI is their profit center, not a complement to it.

This is the same playbook Google ran with Chrome. They gave away a browser for free, which commoditized the browser market, which made it impossible for anyone to charge for browsers, which meant more people were online, which meant more people searching, which meant more ad revenue for Google.

The historical parallel is instructive. In the short term, Google may price AI artificially low to starve competitors, similar to what Amazon does on its marketplace, where they'll copy a successful product and sell it at zero or negative margin until the competitor dies, then raise prices.

But in the long term, Google will want decent margins. Cloud computing looked like a commodity race to the bottom, and yet Azure has 68% gross margins. AWS and GCP are likely similar. The "race to zero" narrative tends to be overstated.

What This Means

If I had to summarize the state of play:

Google has structural cost advantages (TPUs), distribution advantages (Android, Search, Workspace), and is executing better on consumer marketing than anyone expected. They're playing to commoditize AI and protect their ad business.

OpenAI has the consumer brand and the intent data, but they're structurally disadvantaged on cost and don't own their distribution. The path forward is probably leaning into consumer products and eventually ads, not trying to win a frontier model race against companies with deeper pockets and lower costs.

The enterprise API market is going to be rough for anyone without cost advantages. An increasing number of startups, 80% by some estimates, are already running on Chinese open-source models because they're so much cheaper. If Google can get Gemini pricing anywhere close to that, it creates real problems for everyone else in at-scale deployments.

But what can you actually DO about the proclaimed ‘AI bubble’? Billionaires know an alternative…

Sure, if you held your stocks since the dotcom bubble, you would’ve been up—eventually. But three years after the dot-com bust the S&P 500 was still far down from its peak. So, how else can you invest when almost every market is tied to stocks?

Lo and behold, billionaires have an alternative way to diversify: allocate to a physical asset class that outpaced the S&P by 15% from 1995 to 2025, with almost no correlation to equities. It’s part of a massive global market, long leveraged by the ultra-wealthy (Bezos, Gates, Rockefellers etc).

Contemporary and post-war art.

Masterworks lets you invest in multimillion-dollar artworks featuring legends like Banksy, Basquiat, and Picasso—without needing millions. Over 70,000 members have together invested more than $1.2 billion across over 500 artworks. So far, 23 sales have delivered net annualized returns like 17.6%, 17.8%, and 21.5%.*

Want access?

Investing involves risk. Past performance not indicative of future returns. Reg A disclosures at masterworks.com/cd