- Tech Rundown

- Posts

- 🚨💸 OpenAI Spent $1 Billion on Tools That Optimize... Ad Load

🚨💸 OpenAI Spent $1 Billion on Tools That Optimize... Ad Load

Purchase intent data is worth more than you think

Sam Altman spent years criticizing the advertising business model. The internet's original sin, he called it. A corrupting force that turned great products into engagement-optimization machines. OpenAI was going to be different.

That was then.

In May 2025, OpenAI hired Fidji Simo as CEO of Applications. If you don't know who Fidji Simo is, here's the short version: she led the launch of ads in Facebook's News Feed, oversaw Facebook's entire advertising business and mobile monetization, then took Instacart public while building a retail ads business with over 5,000 advertisers. When you hire someone with that resume, you're not hiring them to optimize your subscription funnel. You're hiring them to build an advertising empire.

And according to recent reports, Simo is now actively recruiting someone to lead a new team tasked with bringing ads to ChatGPT. The role will oversee all monetization efforts across OpenAI. Altman's stance on advertising has softened considerably in the last six months. I wonder why.

The Math Is Brutal

Here's the problem with subscriptions: they don't scale to billions of users. Netflix, with 283 million paid subscribers, is considered a massive success story. That's the ceiling. Even with aggressive global expansion, maybe you get to 500 million if everything goes perfectly.

Meanwhile, ad-supported platforms operate at a completely different order of magnitude. Google has 5 billion daily active users. Facebook has 3.07 billion monthly actives. Instagram has 3 billion. YouTube has 2.54 billion. Even Snapchat, which nobody thinks of as a dominant platform, has 453 million daily users, more than Netflix's total subscriber base.

The gap isn't close. It's 10-20x difference in scale.

Let's do the optimistic math for subscriptions. Say OpenAI somehow gets to 500 million paying subscribers at $14 per month. That's nearly double Netflix's global reach, which seems ambitious. The revenue? $84 billion per year.

Google makes over $220 billion annually just from search advertising. Not from all of Google, just search ads.

The addressable market for advertising is simply larger than the addressable market for premium subscriptions. This is especially true when a large portion of the world's population lives in markets where $20 per month is untenable. China, which represents roughly 18% of global population, has banned ChatGPT entirely. India, with another 18% of humanity, has a median income that makes premium subscriptions impossible for most of the population. OpenAI already introduced ChatGPT Go at $5 per month and expanded it to 16 other lower-income nations.

As Rob Leathern, a former coworker of Simo's at Facebook, recently wrote:

"Generative AI demands capital, patience and a distribution channel. The ad engines provide all three. They mint the cash that buys accelerators and pays researchers; they provide billions of daily interactions to test assistants inside search results and social feeds; and they justify custom chips whose first job is recommendation but whose second may be generation."

The Infrastructure Tells the Story

In September 2025, OpenAI acquired Statsig for over $1 billion. Most coverage treated this as a routine software acquisition. It wasn't.

Statsig makes experimentation tools that were built to mimic Facebook's internal experimentation infrastructure: feature flags, holdouts, A/B tests. The company was founded by Vijaye Raji, an engineering leader who worked with Fidji Simo at Facebook, and who will now report to her as OpenAI's CTO of Applications.

You know what Facebook's internal tools were really good at? Figuring out exactly how many ads they could squeeze into the News Feed before users started leaving. Testing whether a nudge kept people scrolling for a few more minutes. Measuring yield and drop-off rates for incremental ad load.

The Statsig acquisition is OpenAI building the same capability that Facebook used to become a $127 billion advertising business. This is not subtle.

The Strategy Behind ChatGPT Pulse

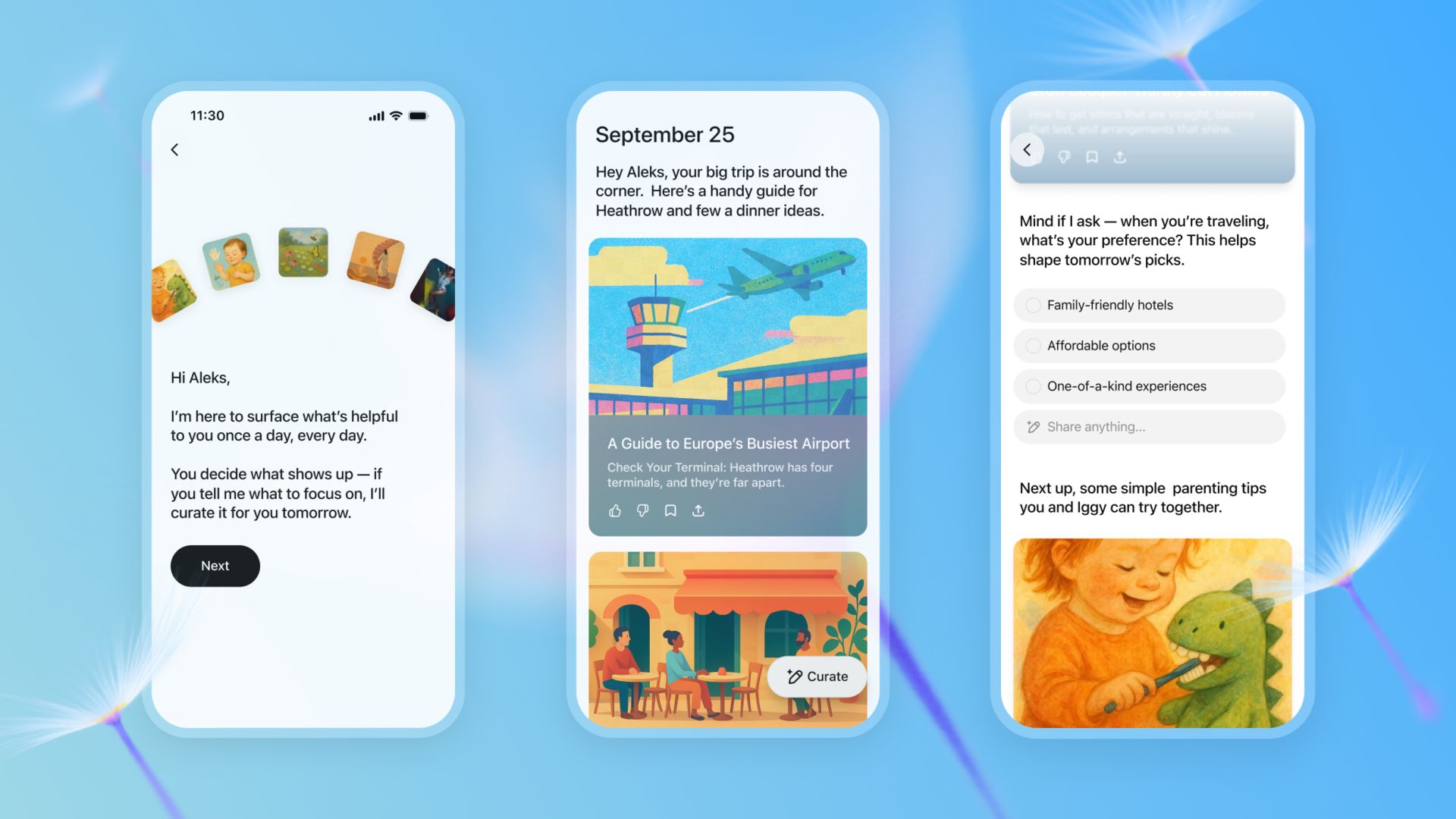

ChatGPT recently launched Pulse, described as a personalization feature that generates reports for users while they sleep. Five to ten briefs to get you up to speed on your day. Updates on your favorite sports team. News about topics you care about. The goal, OpenAI says, is to encourage users to check ChatGPT first thing in the morning - like they would check social media or a news app.

Everyone is talking about Pulse as if it's a convenience feature. It's not. Pulse is a user profiling engine.

Facebook has to infer what you might be interested in based on your likes, clicks, and browsing behavior. It's sophisticated inference, but it's still guessing. Google has better data because search queries reveal intent, when you search for "best family SUV under $40k," that's pretty clear signal about what you're shopping for.

ChatGPT with Pulse is even better. Users are explicitly telling the AI what they care about. Sports teams, stock picks, industry news, personal interests, problems they're trying to solve. And they're doing it willingly, because they think they're getting personalized content.

What they're actually doing is building their own advertising profile with permission.

This is purchase-intent data, the most valuable data advertisers can buy. The CPMs on that data will be extraordinary.

This Is Google's Fight Now

OpenAI is hiring former Facebook advertising executives, acquiring experimentation infrastructure for over $1 billion, and building user profiling systems. They're not being coy about this.

What they're building puts them in direct competition with Google's $200 billion search advertising business. If ChatGPT becomes an ad-supported platform with billions of users, they're competing for the same advertiser dollars and the same user attention.

Google has home-field advantage here, they already have the advertising infrastructure, the advertiser relationships, the measurement tools. But they're also defending an incumbent position. OpenAI is attacking.

The question isn't whether ChatGPT will have ads. The infrastructure decisions and executive hires make that obvious. The question is whether conversational AI becomes a better advertising platform than search. Early signs suggest it might be: longer interactions, more explicit intent, richer user profiles.

Altman can say his perspective on advertising has "softened" all he wants. What's actually happening is that OpenAI is discovering what every consumer internet company discovers: if you want to reach billions of users, advertising is the only business model that works at that scale.

The mission was to ensure AI benefits all of humanity. Turns out humanity doesn't want to pay $20 per month. So now we'll all get free AI, and advertisers will pay instead.

Introducing the first AI-native CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

Join industry leaders like Granola, Taskrabbit, Flatfile and more.