- Tech Rundown

- Posts

- ⚖️ Sequoia Just Betrayed Its $8 Billion Legal AI Investment

⚖️ Sequoia Just Betrayed Its $8 Billion Legal AI Investment

The $1 trillion professional services heist no one saw coming

I've talked previously about the death of the billable hour, the struggles that consulting firms are facing now that some parts of the job can be done internally and the value prop seems very expensive, and how Pricepoint are countering this with proprietary data to provide a service no other firm could to help B2B SaaS companies with growth.

Today I want to dive in and talk about AI-native professional services firms and look at a specific example, Crosby, an AI-native law firm, and the trend to go more vertical. What's particularly interesting is that Sequoia has now backed Crosby, a full-stack AI law firm, even as it holds one of its most public positions in Harvey, the AI legal software company valued at $8 billion that sells tools to traditional law firms.

When the team at Cursor, the hot AI code editor startup, needed a contract reviewed and executed recently, they didn't call a typical Silicon Valley law firm with its army of associates and paralegals. They sent it to Crosby, who turned it around in an hour, a process that traditionally takes days or weeks. No billable hours. No junior associates padding time sheets. Just a flat fee per document and lightning-fast execution.

This is the promise of what might be the most interesting trend in AI applications: instead of selling software to law firms, consulting shops, and accounting practices, a new breed of startups is building their own full-stack professional services firms, powered by AI from the ground up. Think of it as the Uber playbook, they could have sold route optimization software to taxi companies, but instead built their own transportation network. Now that same logic is coming for white-collar work.

Ryan Daniels and John Sarihan, Crosby's founders, one a former lawyer, one an engineer are betting that the global legal services market is ripe for this kind of fundamental reimagining. Their October 2025 Series A of $20 million from Sequoia Capital suggests Silicon Valley is taking the threat to traditional firms seriously.

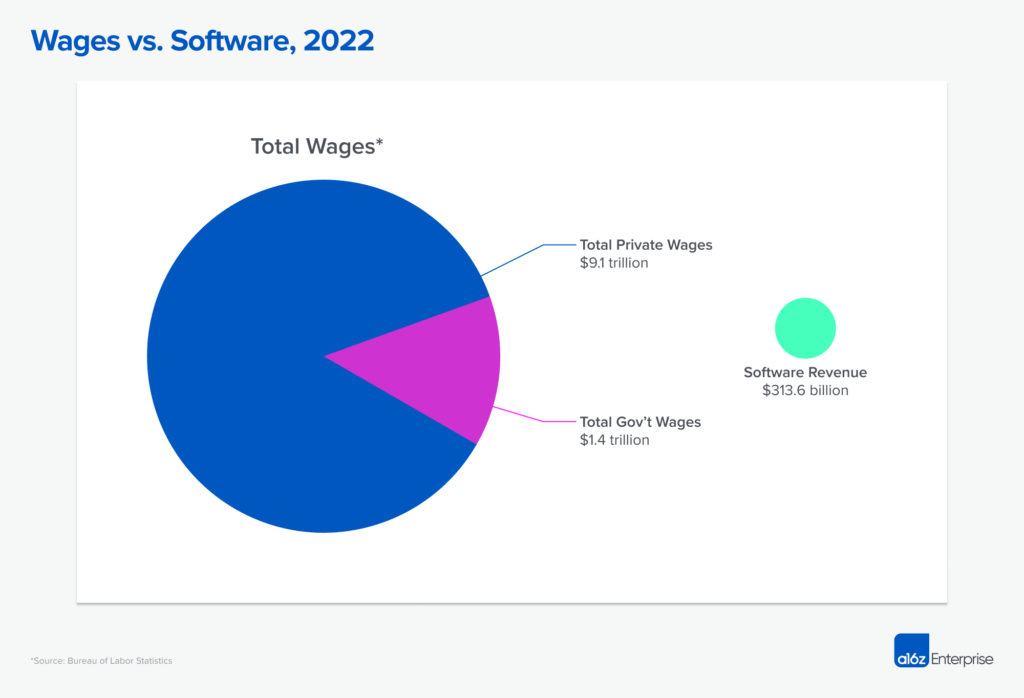

The economics of this full-stack approach are compelling on multiple levels. The most obvious is that professional services command far higher prices than software. While the global software market generates about $1 trillion annually, services spending reaches $16 trillion. The U.S. legal market alone is worth between $305-427 billion annually. A law firm, investment bank, or consulting firm can justify fees that would make a SaaS company blush, because clients are paying for human expertise and time, not just access to a platform.

But there's a deeper transformation at play. Most AI companies today are building what venture capitalists call "faster horses", streamlined versions of workflows we already understand, already staff, and already budget for. If your product is pegged to labor replacement, labor cost reduction becomes your price ceiling. But if you can unlock workflows that humans could never do: impossibly complex coordination or something with infinite permutations, then labor cost becomes your price floor.

For Crosby, this means not just automating research or document drafting, but fundamentally changing the unit economics and operational throughput of legal work itself. By having their domain experts (real lawyers) sit side by side with engineers, they create a unique feedback loop. It's not just about training models on what good legal work looks like; it's about understanding which workflows are best suited for automation, which need human oversight, and which consume the most time for the least value.

The company's wedge into the market is clever: they've eliminated the billable hour entirely, charging instead per document or contract. For hypergrowth startups like Clay and Cursor, who need to process huge volumes of enterprise agreements quickly, the value proposition is obvious, contracts that once took weeks now take hours. But the appeal extends beyond Silicon Valley. Traditional companies are equally attracted to predictable, upfront pricing for legal work rather than open-ended hourly billing that can spiral unpredictably. Aligned incentives mean lawyers aren't padding hours, and CFOs can actually budget legal spend with confidence.

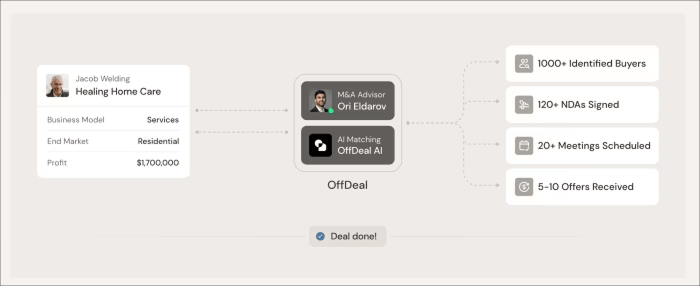

This pattern is emerging across professional services. OffDeal, an AI-native investment bank, recently raised $12 million at a $100 million valuation to automate sell-side M&A transactions. They've built models that scrape millions of business websites to create detailed company indices, automatically generate marketing materials, and manage the entire auction process that would traditionally require a five-person deal team. Cresta is doing the same for call centers, using AI to handle what would traditionally require 800 agents with just 50 human staff members.

General Catalyst has gone so far as to create a dedicated fund called Creation for these AI-enabled services plays, with eight bets already across industries from HOA management (Long Lake) to bookkeeping (Kick, which claims 80% automation). The playbook is remarkably consistent: find industries with highly repeatable processes and lots of manual work, aim for at least 30% automation initially, and target sectors with low client churn where relationships are sticky (read more about their play here)

Not every industry will work. You need the right combination of factors: processes that can be standardized, minimal physical components, and crucially, either pent-up demand or potential for margin expansion. Accounting, for instance, faces a massive labor shortage, many firms could easily take on 50-100% more clients if they had the staff. That creates an opening for AI-native firms to capture market share not by competing on price, but by simply being able to handle the volume.

The challenge for these companies isn't just technical, it's a little psychological. Asking a traditional law firm partner to adopt software that directly cuts into billable hours creates an impossible incentive conflict. But offer clients a service that costs 20% less than their current outside counsel, with 50% lower internal costs, and you can capture much higher budget.

The deeper insight here is about market expansion. Every organization has a wish list of things they'd do with unlimited resources (more cold outreach, better lead generation, constant recruitment of top talent). These tasks sit perpetually on the back burner because there's never enough time or budget. AI-native firms can attack this latent demand, creating markets that didn't exist because the economics never worked with human labor alone.

Investors like Thrive Capital, Elad Gil, and Sequoia are placing multiple bets across the space, recognizing that professional services might be where AI creates the most dramatic value capture. The transformation won't happen overnight, and not every attempt will succeed. Some industries will fall into price compression while others will discover enormous elasticity in demand.

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.