- Tech Rundown

- Posts

- The New $400M ARR AI App Builder

The New $400M ARR AI App Builder

Airtable's pivot could destroy Replit and Lovable

Here's a thought experiment: You're sitting on $400 million in annual recurring revenue, you've raised $1.4 billion at an $11 billion peak valuation, and suddenly a bunch of AI coding startups are making your core product look like Microsoft Access with better fonts. What do you do?

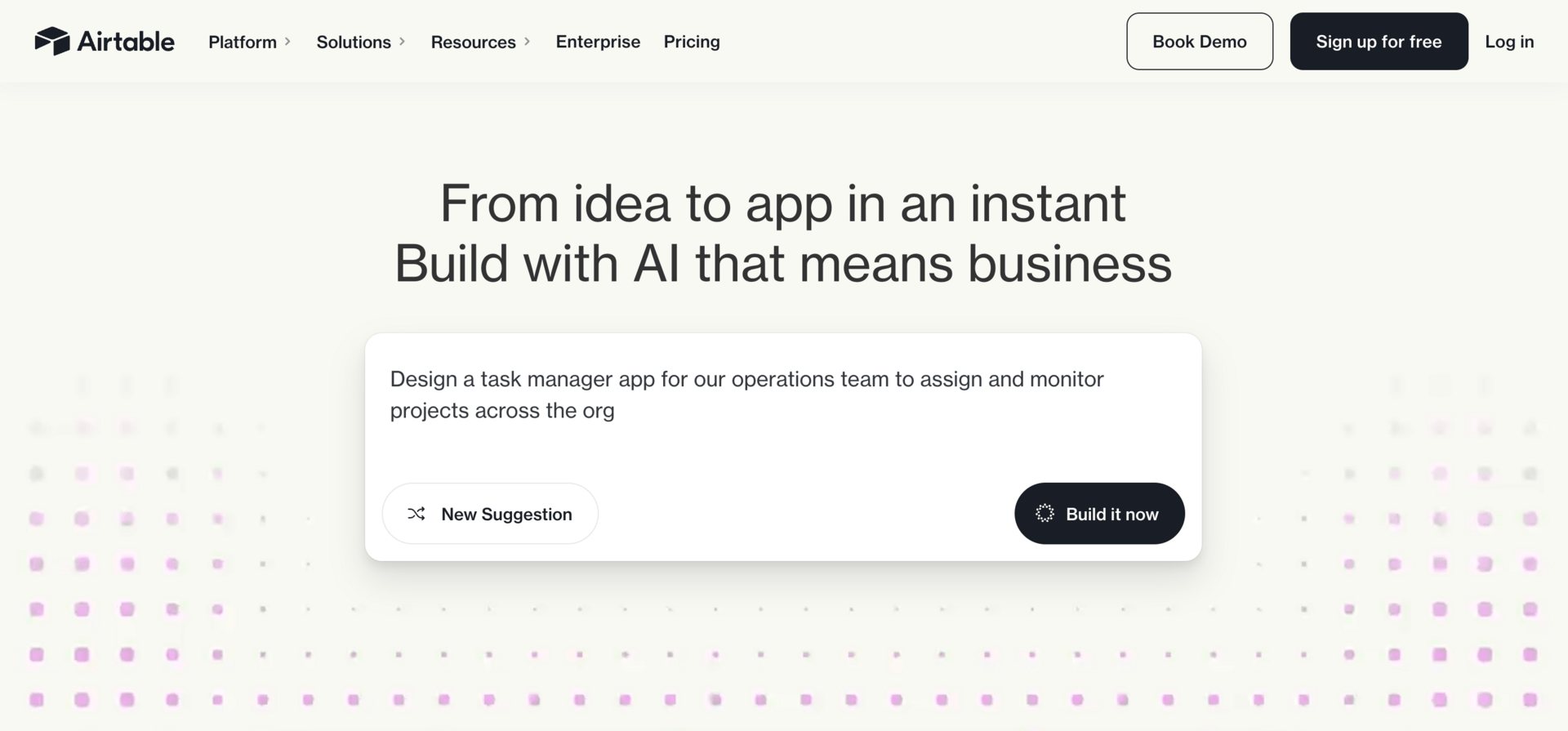

If you're most companies, you probably add some AI features, hire a Chief AI Officer, and hope the disruption passes you by. If you're Airtable, apparently you pivot your entire company to become an AI-powered app builder.

Airtable’s New Homepage

A lot of people have been disparaging this move, but I think it's actually quite interesting, and potentially one of the few examples we'll see of a large-scale company successfully pivoting after facing existential disruption.

Why This Pivot Makes Sense

Airtable isn't trying to compete with Lovable or Replit on building frontend prototypes and mini web apps. They're going after something more specific: internal business apps that connect to existing company data.

This is smart for two reasons that most observers are missing. First, they're uniquely positioned to solve the two biggest barriers to adoption for table-based tools: the complexity of setting up a table from scratch, and the effort required to populate it with useful data.

An AI chat interface dramatically reduces setup complexity (you don't need to manually configure schemas or decide which columns to create). Meanwhile, AI agents can scrape the internet to automatically fill tables with relevant data (vs manually having to populate data yourself).

Second, and more importantly, they already have something that pure-play AI coding tools can't easily replicate: hundreds of millions of existing tables filled with enterprise data, plus existing contracts and approved vendor status at large companies.

Employees at enterprise companies are limited by what they can build with Lovable or Replit not because of technical limitations, but because there’s not a chance in hell their security team is letting you connect your vibe-coded app to their data warehouse. Airtable already has the enterprise relationships and the pre-existing data within their tables.

But this isn’t exactly a straightforward move. Very, very few companies have ever successfully pivoted their core product at this scale. Airtable are already at $400M ARR, we're not exactly talking about a scrappy startup changing direction when their first product doesn't get traction.

The closest parallel might be Wix, the website builder, which saw similar AI coding threats and acquired Base44 just eight months after the startup was founded, paying $80 million. Now they're putting massive ad spend behind Base44 and reportedly growing ARR by $1 million every 2-2.5 days. But that required buying their way out of the problem rather than building internally.

Commoditising the Complement

Here's where Airtable could get really aggressive: make the AI coding completely free.

This would be classic "commoditise your complement" strategy. The complement here is AI-powered app building (the thing that Lovable and Replit charge for). If this new product and the reduced barriers to creation mean far greater Airtable usage then they could sacrifice the coding revenue stream entirely and focusing on making money from table creation, data storage, and AI scraping services.

Think about the enterprise sales conversation: when a company is getting pitched by both Airtable and Replit, they'd see that Replit's core product is essentially bundled free into Airtable, and Airtable only charges for storage and scraping — costs they'd need to pay anyway. The coding capabilities come at no additional cost.

The Problems That Remain

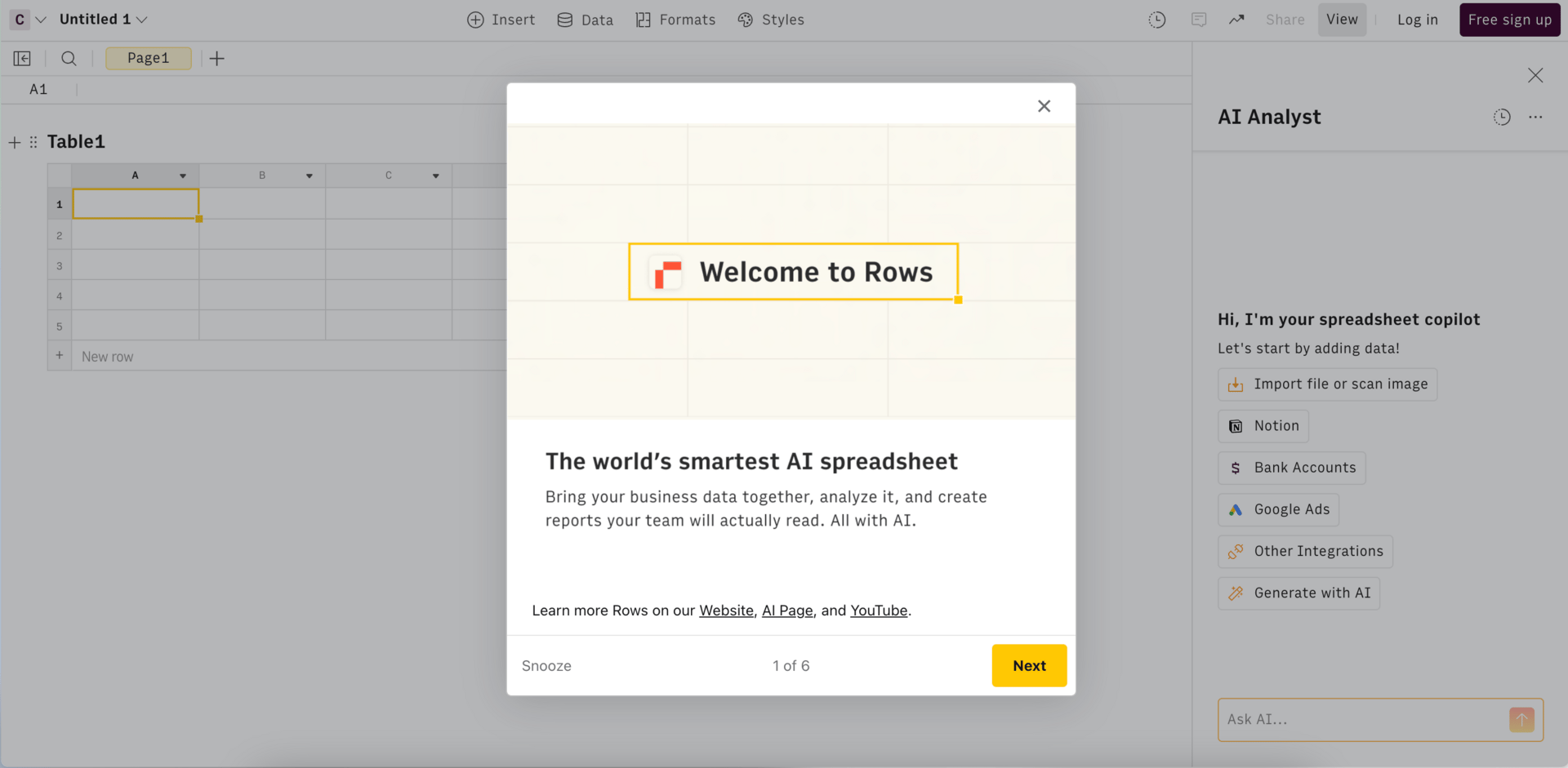

Of course, there are still major challenges, the biggest being go-to-market complexity. Clay, Rows and Equals were all startups that struggled with Airtable’s exact new value prop - excel with live data. They all struggled to reach any scale because it was too horizontal a tool and nobody could be bothered in figuring out how to build it for their use case.

Rows - The Spreadsheet w/ Live Data. Sound familiar?

Clay only succeeded, and has now seen a massive revenue acceleration by laser-focusing on sales teams. Put in someone's email, get back their LinkedIn activity, job title, company info. Simple, viral, obvious value. Airtable is trying to serve everyone: operations teams, marketing departments, sales organizations, legal teams, even dentists. Each has completely different use cases and workflows.

This is a pretty common horizontal product curse. Unlike companies that can rely on product-led growth spreading virally through a specific user base, Airtable will likely need to deploy customer success engineers directly into client organisations to identify and implement use cases. Think Palantir's forward deployment model, or how OpenAI and Mistral embed technical experts into large customers to discover workflows that AI can automate.

This approach works, but it's expensive and doesn't scale as elegantly as pure product-led growth. It also requires a different type of organizational muscle than Airtable has traditionally built.

But at least they're trying something more interesting than adding a chatbot to their existing product and calling it "AI-powered." Whether this works is anyone's guess, but it's one of the few examples of a large company actually taking AI disruption seriously enough to bet the business on it.

How 433 Investors Unlocked 400X Return Potential

Institutional investors back startups to unlock outsized returns. Regular investors have to wait. But not anymore. Thanks to regulatory updates, some companies are doing things differently.

Take Revolut. In 2016, 433 regular people invested an average of $2,730. Today? They got a 400X buyout offer from the company, as Revolut’s valuation increased 89,900% in the same timeframe.

Founded by a former Zillow exec, Pacaso’s co-ownership tech reshapes the $1.3T vacation home market. They’ve earned $110M+ in gross profit to date, including 41% YoY growth in 2024 alone. They even reserved the Nasdaq ticker PCSO.

The same institutional investors behind Uber, Venmo, and eBay backed Pacaso. And you can join them. But not for long. Pacaso’s investment opportunity ends September 18.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.